Exchange

An Exchange Ontology for Civilization

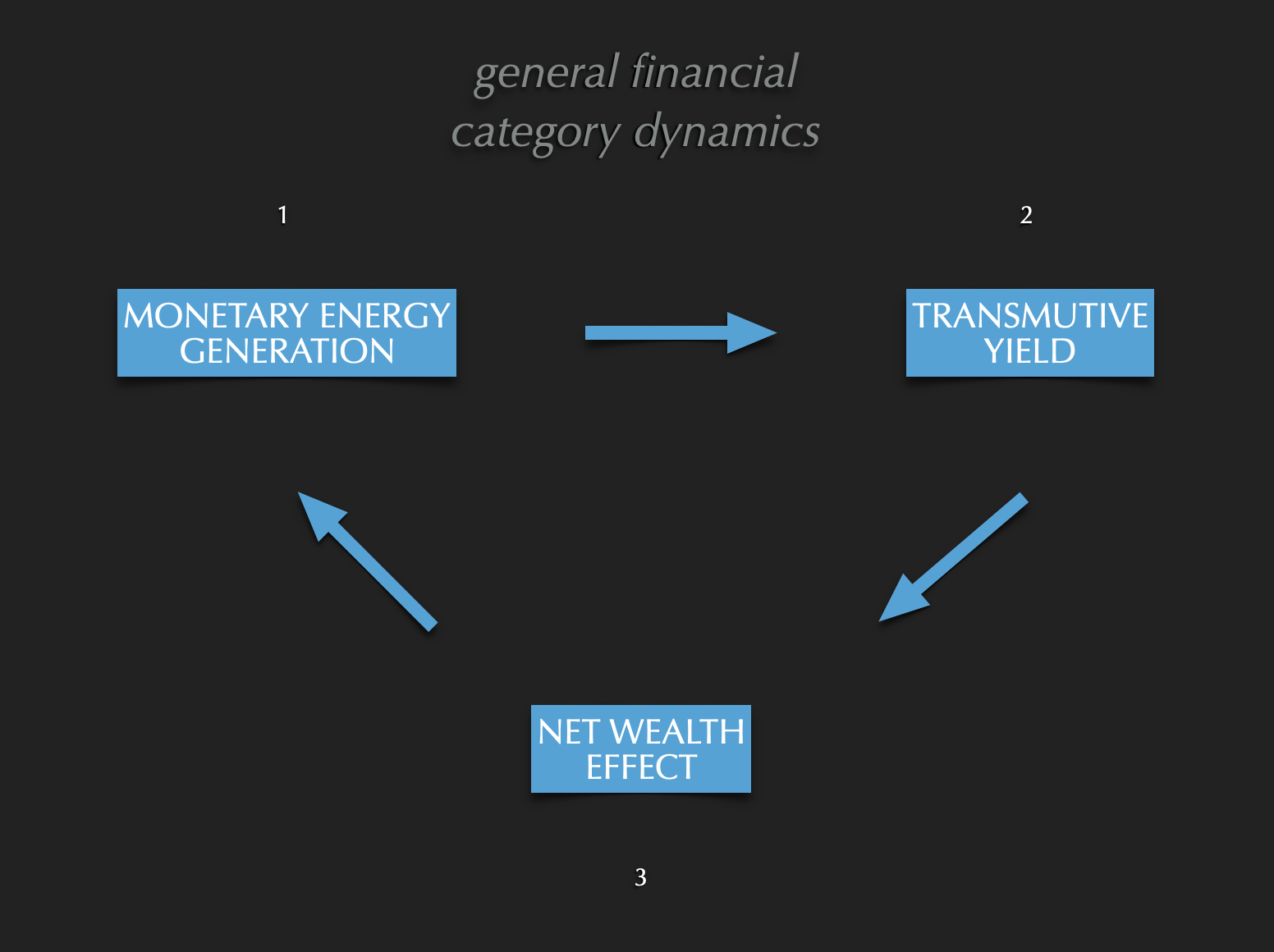

An upstream financial model can be deployed when each qualifying publicly traded yield asset extracts a spot trading fee through an exchange such as glasshouse. This model can enable the dematerialization of 2D price maximization for goods and services while maximizing bottom line beyond prior equity inflation cycles.

ESP curates IP for the engineering overstructure for the next state of exponential growth in hardware and software. KPI-gated valuation can ensure continuum look-ahead, considering near, interim, and long-term inflation versus innovation impact. Vocation and volition, perceptible to all, can stabilize our shared timeline.

Revenues are collected upstream based on the movements of a given yield asset. The compliance detail, ongoing infrastructure, and QAQC integrations for this ontology can be deployed through glasshouse.

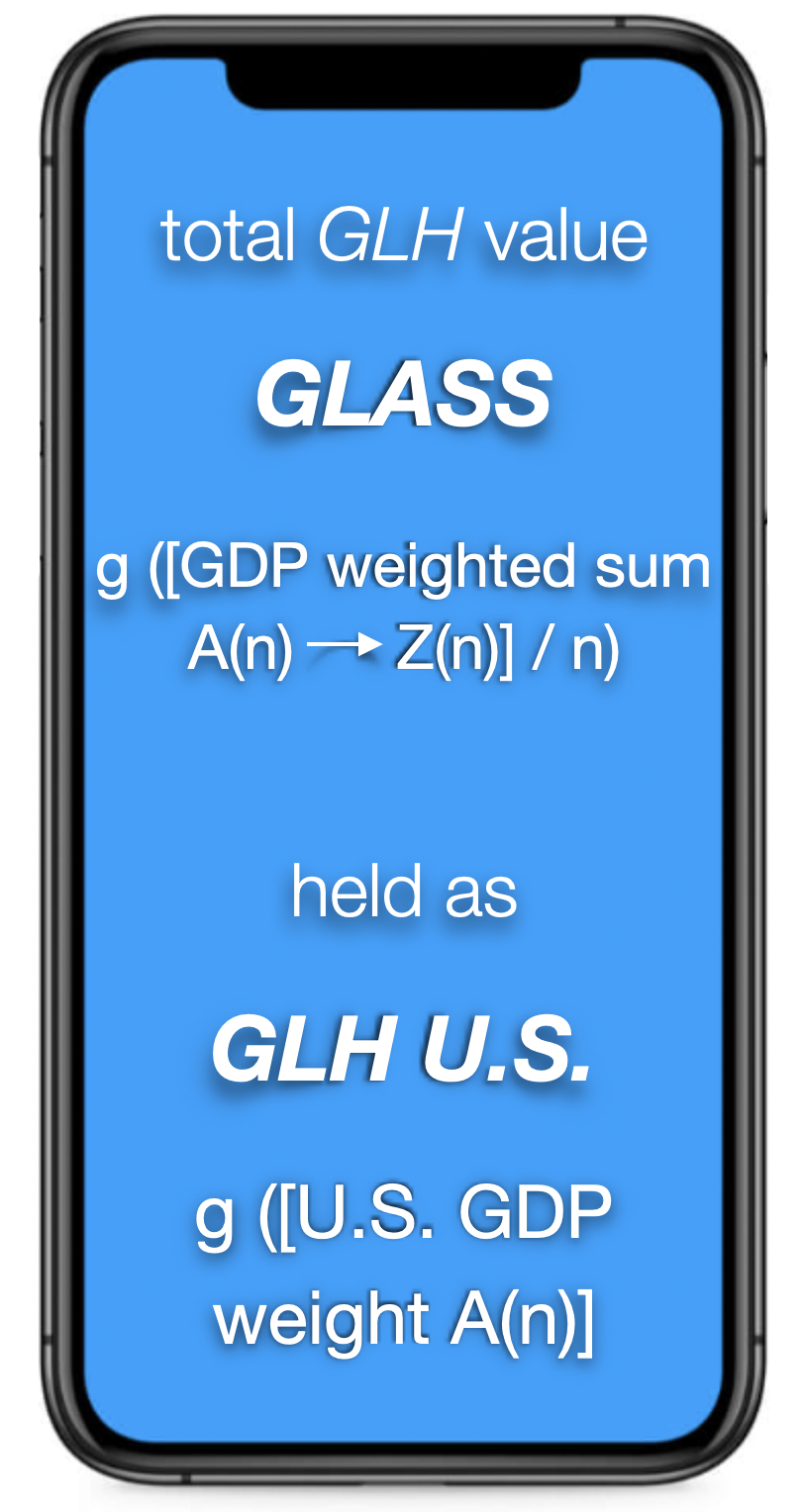

The value of glasshouse platforms trades through the commodity GLH, the value of which can be abstracted into GLASS. There is no yield asset designated for the platform itself, as it represents nodal value allocated toward coherent throughput of the arena.

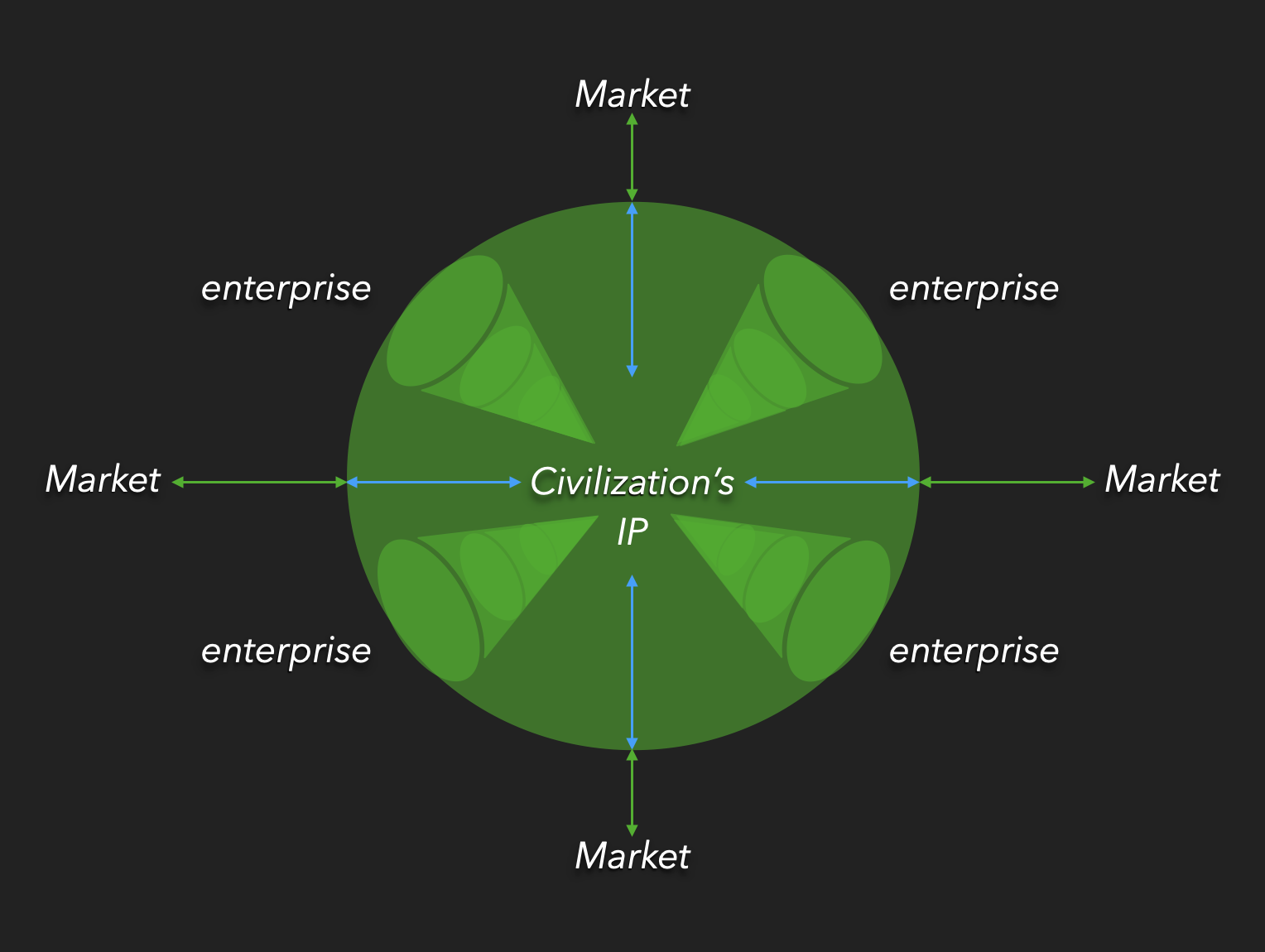

glasshouse as an exchange can enable each qualifying publicly traded enterprise to seamlessly and cheaply integrate the revenue model inherent to an exchange ontology. That is to say, a glasshouse exchange can enable enterprises to extract a nominal fee for each spot transaction.

HFT firms extract a fee based on their faster-than-you throughput of $.004 per dollar transacted on average. glasshouse as an exchange can align a fixed fee of the greater value, $.016 per dollar transacted, attributable to core enterprise earnings.

To facilitate continuous financial viability, enterprise governance deployments are stated as inviolable legal and technical financial engineering proclamations in each enterprise charter. glasshouse as a marketplace dapp is instantiated to be monitorable and publicly auditable in real-time for all institutional trade flows.

A systemic lack of dark pools facilitates top line.

Core Products

Every instance of monetary energy movement can be tracked and publicly audited in real time. On test nets, such as inverse, all workflows can still route onto a glasshouse UI as a public test net.

glasshouse exchange QAQC parameters can be provided at a cursory glance in specific provisos, such as:

There can be no enterprise insolvency operations where reserve structures are depleted to satisfy operational expenditure.

All public repositories and enterprise sources of financial throughput are tracked.

Enterprise workflows validate yield accretion plausibility clauses for all leverage sought.

Sustainable sARR is achieved in enterprise value equilibrium/a.

For enterprises deploying yield assets on the platform, any lock-up authorizations can be signed per moment of purchase.

Public contract fulfillment for public imperative, market liquidity, and false hydras are auditable in real-time.

Buybacks are limited only to validated, direct net wealth distributions as explained by the core ontology

All yields are incentivized to be routed into capital formation funds, and the realized liquidity is sent directly to households.

Blockchain networks and stablecoins are currently only able to assert non-enterprise proxy claims to funds. They cannot enable the onset of sustainable aggregate. Enterprise involvement in the emergence must be present, encompassing total arena contract claims and recourse.

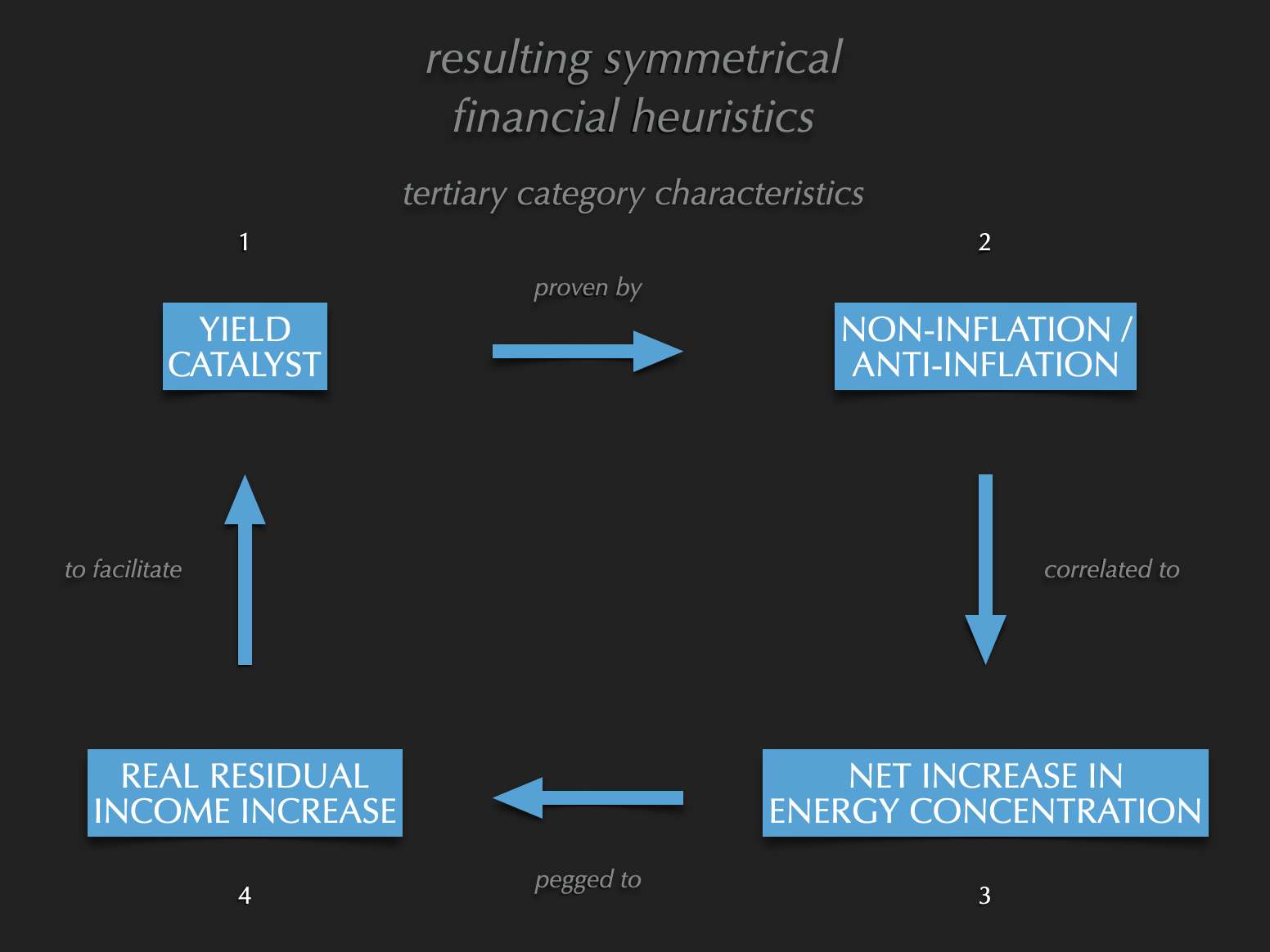

Year-over-year increases in the magnitude of global yield asset transaction volumes during bull cycles can provide favorable growth and stability prospects for earnings. QAQC heuristic routes extended by KPI gate limits can catalyze workflow according to reconnaissance by the public of biologically imperative enterprises.

Any resulting revenue bloat can be reinvested into civilization as accounting artifacts. glasshouse catalyzes and scopes non-inflationary wealth distributions directly to households and industries.

Sustainable innovation and public data repositories are akin to potential energy. The accretion and conversion rate of productivity metrics to asset prices depends on the extent of modally aligned deflation sustainability.

Given public, real-time enterprise finance metrics, the requisite dematerialization of 2D prices can be perceived on glasshouse. The overarching capital management and yield imperatives can be curated and deployed publicly by enterprise boards through heart.

heart enterprise wallet platforms describe any ad-hoc or formally contained enterprise and/or board-related business unit oriented toward meta-market data structure. It can be the meta-ontic landscape that deploys modally adaptive currency and yield asset management ontologies.

The related throughput for reconnaissance by the public can be perceptible in glasshouse. This effort is usually an attempt to continuously perceive with greater insight both within and beyond a given enterprise, continuously or at critical junctures. The ontology deployed can enact sustained, steady-state operational productivity in the face of mitigating unknown entropies of a civilization’s viable traverse.

Many free-to-all products can take the form of stochastic reasoning engines SREs and stochastic causal inference maximizers SCIMs via gauge-pressure applied schematics, IP, and software. At scale, these collaborations can enable pre-mitigation and achieve a target of three times broader monetary stability, as measured by non-inflation and modally adaptive deflation, through a market productivity asset.

GLASS as a weighted aggregate of global GLH can be purchased as a global yield asset, separate from specific regional GLH.

Only primary dual residence and citizenship can enable one to hold specific multi-region GLH.

A compute core for wealth distributions can account for non-inflation and modally adaptive deflation granularly, per niche region.

‘Locked asset holdings’ are, from the perspective of the liquidity provider, who then sends net increases of market value as wealth distributions in ESP-V to heart wallets.

This separation of regional utility products and services from primarily macro capital management benefits the ongoing client surplus. Ongoing investment needs can be made more salient given the fluctuations in asset yield and the need for real-time financial transparency and relevant tensors. Therefore, the more granular dynamics can tend toward statistically greater odds of short-interim and long-term civilization-wide remediation and renumeration.

The relevant agent-to-agent interactions necessitate transactions involving yield assets through liquidity providers, hedge funds, custodians, brokerages, and clients.

These client and institutional interactions are currently deployed at a scale devoid of modally adaptive agent-arena incentive mechanics. The rational space of game-theoretic states is, therefore, compromised in terms of definite yield recourse. This maladaptive dynamic makes the arena largely unusable.

In addition to SCIMs stochastic causal inference maximizers, by way of SREs stochastic reasoning engines, products, and exchange services, glasshouse can facilitate manifold standardization ontologies for utilities, products, and services within and beyond the global arena of financial throughput. This IP throughput, tailored to specific geographic needs, can take the form of Applied Engineering Schematics per Industry Verticals.

The current approach to revenue accretion is literal to the in moment end product or service point-of-sale.

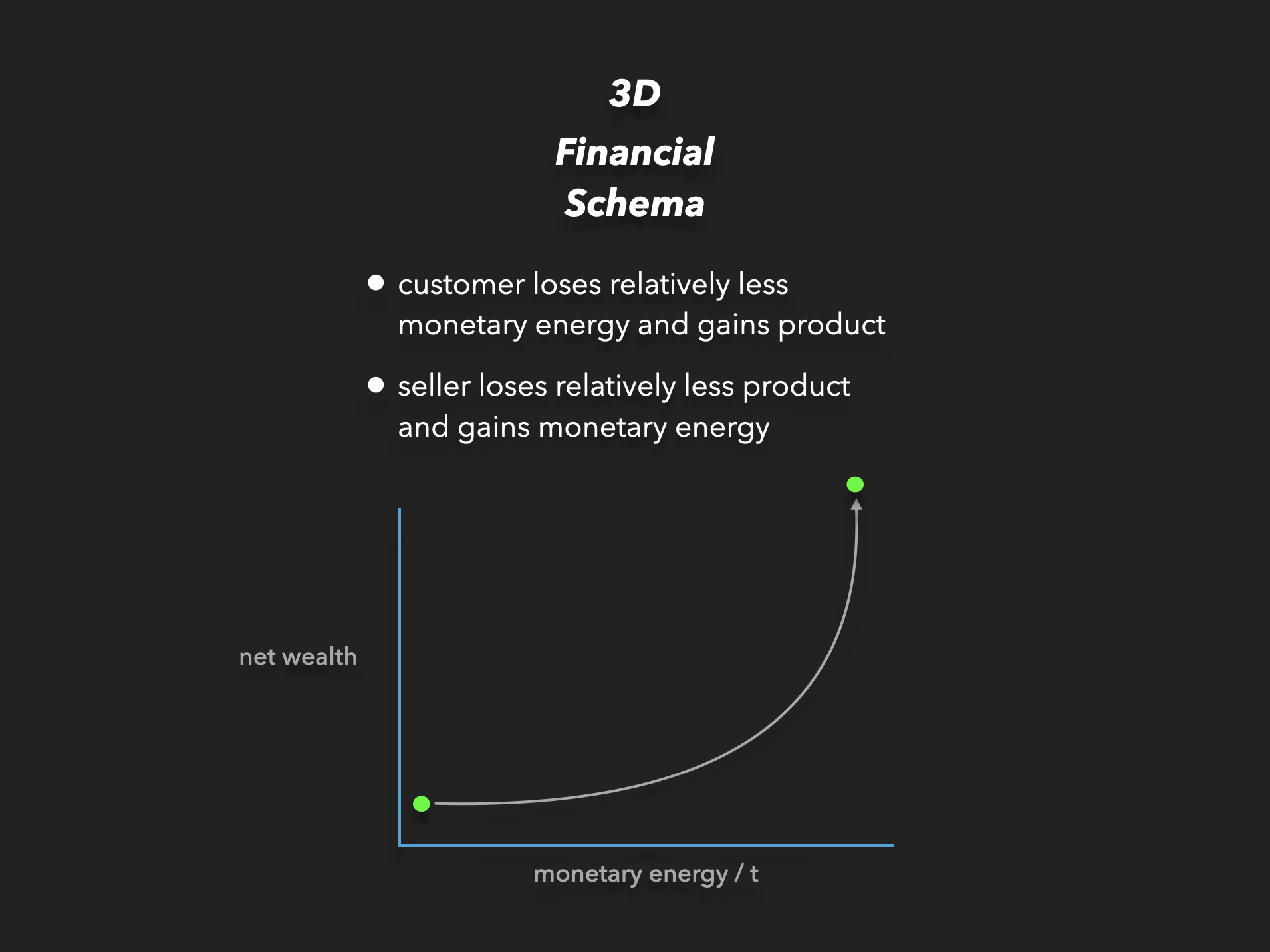

Funded by trade fees, 3D financial dynamics can geometrically outearn a 2D scheme in revenue. In delayering from that approach, modally adaptive deflation can benefit total household wealth.

For an exchange to facilitate logistics with financial intermediaries and clients, infrastructure must exist for coherent throughput of monetary energy. Beyond adherence to enterprise governance, the current exchange-to-market orientation lacks a regulated and auditable correspondence between collective agents and shared scalar series.

In a world of global yield asset transactions, it is crucial to have a harmonic enactment of hardware entropy, routing on energy density rather than sub-zepto-second time parsing. Superfluidic energy compaction in field lattice-enabled computing is the key to this.

The financial system writ large requires an additional dimension of energy capture. This revenue model can account for strenuous demand from new global monetary energy when distributed broadly to new and institutional market participants. The global supply of wealth is otherwise limited as it derives from a pre-existing 2D schema.

This is important because so much global wealth derives from productivity in global yield assets. Our shared civilization can become logistically destabilized as financial markets swell in monetary energy and acceleration, with no consensus unification architecture in end-to-end transaction throughput. Maladaptive incentives can arise from an unstructured financial arena. This can become a pervasive infringement that capitalizes on a lack of market ontology.

Maruader dynamics can play out at scale, generating novel and imperceptible entropy. The breakaway momentum therein can compromise the safety of civilization’s wealth.

Beyond enterprise governance integrations and exchange services, glasshouse can provide ancillary products and services in the form of free and open IP and liquidity to civilization.

Resources can be available broadly per population and more granularly in anonymized aggregate data sets. Client identity per individual preference beyond KYC / AML can remain the sole domain of client volition. The data trail of client essence can also be retained or withheld on the platform per the client’s preference in glasshouse utility. Data sharing can gain a telos devoid of the malformed incentive mechanics in maximizing prices of 2D goods and services.

The device's electromagnetic dynamics are not sophisticated enough to generate a worthwhile bionatural signal on their own.

Bionatural signals can enable novel dynamics of habitation.

The sum of all efforts can emerge as households and industries are increasingly compensated through modally adaptive deflation and new liquidity. A globally collaborative deployment can incline civilization toward breakaway wealth dynamics across disparate enterprises.

In a world of global yield asset transactions, it is crucial to have a harmonic enactment of hardware entropy, routing on energy density rather than sub-zepto-second time parsing. Superfluidic energy compaction in field lattice-enabled computing is the key to this.

Nascent launch pads can mature to offer assets more deeply rooted in global yield aggregates.

The traditional ‘closed IP enterprise’ approaches fractionate IP and piecemeal it into the market.

The contemporary ‘open IP enterprise’ approaches aggregate IP, enabling civilization to pull more market.

Sustaining Invention

Sustained productivity can be generated by incentivizing cost-side innovation. These costs include the impacts on shared community resources and stakeholders. Wealth impacts are measured not by the excess monetary energy derived but rather by productivity in embedded yields to civilization.

By enabling the throughput of liquidity to address productivity in biological imperatives and QAQC, we can safely draw in wealth correlated to the future yield-generating dynamics we put into effect. We can provide civilization with the tools to value wealth from 3D financial schemas. The very people and enterprises we invest in daily can participate as stakeholders. A more virtuous cycle of innovation and investment can be made manifest.

Due to the financial engineering implications that computational information design provides, we can appropriate the value generated by commodities and the resulting assets directly to industry and households per the geographies in question.

glasshouse exists to iterate through the most geometrically stable foundations of imperative capability. This maximizes the amount of kinetically available, modally adaptive build potentia. The temporal structure can, therefore, conform to an ontologically enduring infrastructural morphism.

Enterprises have the ability to do something truly historic. Civilization can unlock the incentive pressure to take on a comfortable, safe, and exponential pace in digital throughput.

glasshouse and GLH reflect a critical lack of digital financial logistics infrastructure for collaboration and reconnaissance by the public regarding digital commodities for households, industries, and public goods.

Regarding asset prices and the precursor productivity they must convey, enterprises can adopt this less entropic orientation through procedural scopes of work. Rational, emergent, qualitative, and manifest bandwidth deployments can gain modally aligned volition.

Low Entropy

The concept of a civilization wealth fund can be derived through stakeholder enablement by way of malefactor dematerialization. AI actualization can be a process of continuous integration given biological imperatives, core life processes, and ongoing QAQC. In market economies, these structures take shape through enterprise.

The 3D business model described herein is broadly attributable to high-volume global yield assets. The resulting accelerations of new market cap onset can be entirely unencumbered by goods and services inflation.

Novel economies can generate an upswell of monetary energy devoid of net new inflationary pressure and deploy modally adaptive deflation. Given biologically imperative IP, this liquidity can be converted into civilization-wide wealth if there is a direct line of sight from stakeholder-market to enterprise-civilization orientations.

This modular and attentional deployment is the vector of shareholder profit maximization. Psychic bandwidth attribution can efficaciously and efficiently enable further yield compounding through stored monetary mass and acceleration. Correspondence such as this aligns further upstream in yield asset liquidity flows from household demand.

A wealth premise afforded by fractions of a cent in exchange for yield assets funds civilization rather than 2D prices for goods and services. Our civilization must migrate away from the extractive siphon to <insert> pulled from each household’s or industry’s yield attributions in market-facing cash flows rather than net income equivalents.

A bastion of streamlined earnings flows extends to enterprises the ability to maximize bottom line via modally aligned attention. This procedure can be enacted through iterations of yield assets in the form of globally regulated civilization commodity aggregates and domestic securities.

To achieve this, it is necessary to systematize a logistical flow that assures monetary energy mechanically converts seamlessly to net new wealth. This impact on M2 can stabilize further up the funnel into M3 and so on.

The total oversight in reconnaissance by the public, collaboratively oriented to enterprise productivity, can be computationally aligned to deploy granular non-inflationary bias. This dynamic can even take on an anti-inflationary bias in modulating beyond the scope of M2 as enacted wealth for civilization, along with liquidity distributions to the public.

As prices are dematerialized, civilization may not hit hard limits in scaling new industries. Today, there is an arbitrary limit on deploying ready-to-scale civilization-wide advancements. Given the current financialization schema, an upper bound is placed on civilization’s scale given inflation from higher wages, growing demand from accelerating global economic activity, and related yield-seeking by global wealth.

The entailment cones of collective modally responsive imaginal can thereby govern new invention. heart, as in part an enterprise of boards, can facilitate ontic deployments of diverse ontologies to all enterprises.

A 3D financial schema gains stability by utilizing the most meaningful and available total value of high-throughput post-IoT infrastructure. The global delivery of next-gen applied schematics, software, and hardware can provide attentional attunement and sustained upstream revenue traction. Utilitarian curation can gain a footing to remediate resource asymmetries and stabilize emergent technology.

Post-industry, post-IoT formalisms do not necessitate spatial unit equivalent footprints to build and deploy. Novel, discrete-scale field lattice-powered equipment deploys to industrial scale from tabletop devices. Furthermore, beyond-speed-of-light action completion necessitates high bandwidth permeation QAQC to resolve the catalyzation and curation of megalithic-scale build vectors.

The concavity of exponential industrial tech necessitates equally steep orders of magnitude increases in total wealth permeation and global compliance. heart serves as an ontic exertion to all in arena enterprise throughput and validation of monetary energy to enable distributive net wealth effects.

The computationally attenuated net wealth effect can increasingly convey premium utilities to civilization at increasingly nominal prices. That is to say, when broadly enacted through global yield assets, the business model described herein can dematerialize the prices of 2D goods and services.