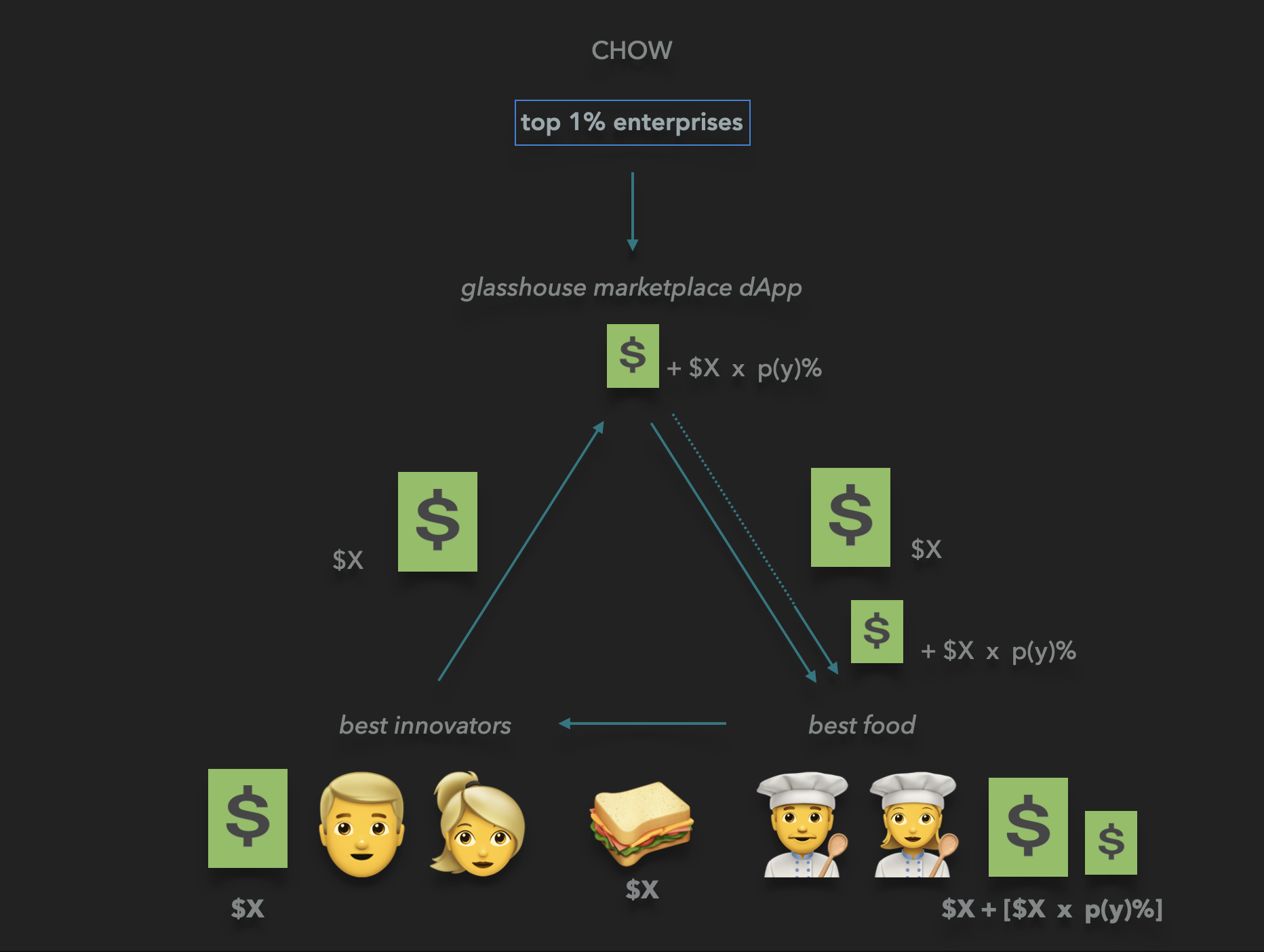

Households can be compensated with direct payments from CHOW yield asset trade fees. These wealth distributions can be structured to facilitate modally adaptive deflation, offsetting food expenses.

According to Core Life Utilities innovations, CHOW can cover a portion of daily calories for high-performing civilians. The platform can send resulting yield liquidity and IP to the top 1% of businesses in high-yield industry categories for core life utilities.

CHOW can compensate all high imperative sections of the downstream supply chain via liquidity throughput and revenue mechanisms described below.

CHOW is the throughput to pay high-performing households and restaurants directly per meal

reflects a direct increase in immediate, real net residual income for recipients

enacts community oversight, civilization-wide enacted yield, and incentives to benefit modally aligned earnings from CHOW yield asset

CHOW productivity and corresponding yield assets can permeate as increasing global bandwidth orients

glasshouse can facilitate exchange as an auditable, global reporting structure. Public data throughput repositories can offer QAQC tools and networks. These dynamics can approach compliance levels an order of magnitude above what global commodities and securities laws dictate, as measured by diverse transparency and productivity metrics.

Relevant reporting accommodations can be curated based on differing standards through regional capital formation funds. Client funds can be assigned per voluntary yield asset transaction data, such as the specific geography of an individual or entity. glasshouse can further curate and funnel liquidity IP workflows, deployments, and yield capital.

On an enterprise voluntary basis, selected ongoing workflows can be placed on an online, searchable network, making them publicly visible to anyone. glasshouse constitutes functionality in stakeholder engagement and iteration rather than hype marketing or arbitrary brand perception.

Monetizing data is not part of the revenue model; therefore, personal data can be provided or withheld on a client-voluntary basis to enhance shared product and service experiences.

CHOW will portray an example of how all glasshouse enterprises can deploy a trade fee distribution strategy to extend and embed wealth. This formalizes the strongest possible stock-to-flow demand pull incentive.

The revenue model for glasshouse enterprises is described in the subsequent section titled, ‘III. Digital Commodities, Revenues & Cash Flows’.

Unstoppable blockchain networks, crypto, dimensionless artificial intelligence, and now dimensioned arity transformation can liberate M3 and M4 in a global QAQC format. Orders of magnitude wealth unlock are imminent and necessary for global demand.

Enspire ESP digital sovereign and LOV phase shift platform actuate the mechanics of novel energy magmas, while glasshouse and GLH enterprises deploy entropy maps of sell-side inflation. The curation of these dynamics enables GIFT to provide free wealth distributions to holders of the HEART wallet in VELAR, a native, sovereign unit of account.

Accounting for governance, yield assets, and enterprise products and services will then reveal how CHOW maximizes trade revenues while driving traditional point-of-sale costs toward $0. Beyond upstream trade fee revenue, the surplus productivity enables funding of all core high-leverage processes in the value chain.

Due to imminent currency pressures, more wealth must be allocated and stored in global yield assets. Only a finite amount of fiat issuance is attributable as liquid currency due to the productivity constraints of debt. In a protocol compliant with global QAQC, M2 can safely grow geometrically over the next decade.

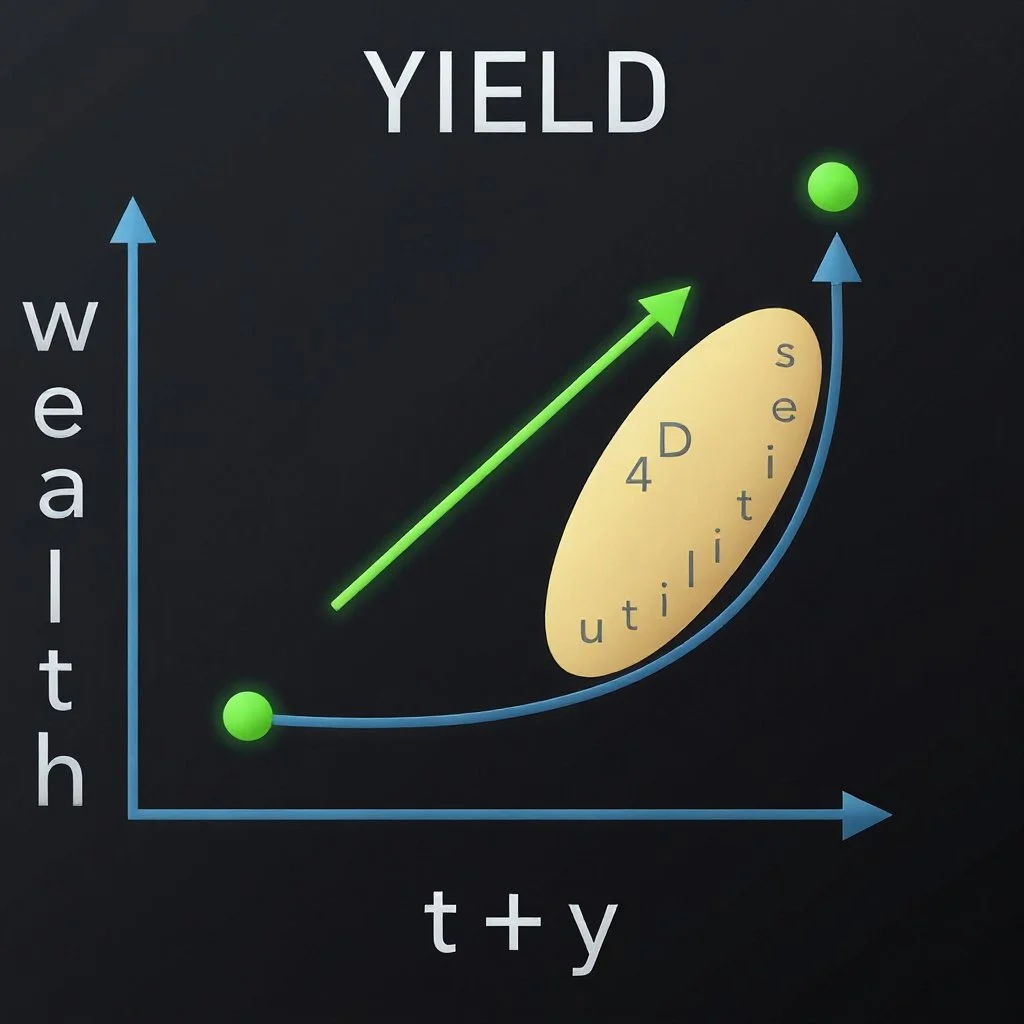

A preliminary, emergent arity transformation of wealth yield is expressed qualitatively.

Enspire ESP is a digital sovereign that issues network software in the form of global yield assets.

Transcendence beyond conflict game theory enables civilization’s imperatives and qualia to flourish. Rationality and qualitative forms are nearing a culmination arc, so manifestation and emergence are crucial for thriving.

Entropic dynamics on the spectrum from skirmish to xenocide seldom emerge for viable logistics and decision kinetic reasons. Populations utilizing different levers of sentience produce dynamics with unintuitive shared kinematics. Opponents often leverage non-viable extrapolations and inferences of perceived future resource scarcity to justify the escalation of conflict.

As war negatively impacts education in the moment, it disproportionately frays the societal fabric and causes further strife. Enterprise values are therefore leveraged directly upstream of education in research and governance vocation. This orients liminal incentives away from conflict hyperization as it would deprecate market value and total sustainability efforts of enterprises.

The governance dynamic reflects enterprise consortia that deploy private funds for public imperatives. The arena can be a democratic approach to ‘innovation capitalism’ with no centralized executor. Total market perceptibility enables and curates effective administration. This concept affords more opportunities for both democracy by proxy and direct democracy.

Regulations for high-throughput ensemble governance can be convened where purely spatial governance formalisms are lacking. Existing sovereigns and nation-states lack a communications context that facilitates alignment between the private market and public imperatives. Ontologies can be curated and parsed according to a population’s specific criteria.

As an adjoining governance format, the premise is beyond an upstream interface for exogenous technology. The lack of a spatial domain may not inhibit the capacity to provide products and services to diverse populations. This characteristic can be a core capability in cohering QAQC to ongoing technology leaks and saturating the modal adherence broadly.

Per individual choice, providership toward common goals can be advanced without a concept of citizenship. Novel dynamics in civilization’s development arc enable high-bandwidth refinement, an approach to neutrality granted by normative heuristic epistemologies that transcend conflict game theories. These exertions of manifestation and emergence can persist at a rate commensurate and liminal with rational and qualitative bandwidth.

This formalizes the capacity for CHOW and other core imperatives and qualia to functionalize surplus yield flow, enabling financial zeroism in the section below titled ‘III. Productive Surplus from Trade Fees’. A document titled ‘ESP Enterprise Governance’ will be released in Q2 2026.

Click the ‘Mailing List’ button above to receive updates through e-mail or social media.

lov is a phase shift and inference model for magnitude and pressure entropy maps.

The model utilizes harmonic resonance mapping for both hardware and software, enabling a diverse range of use cases across various domains. American derivatives can be curated in total public view, formalizing publicly perceptible operational expenditures. Novel biomedical devices, built using innovative hardware called field lattices, can shape a clean energy future where quantum features transform our experience of time.

Yield asset scarcity can intuitively track the flow of demand. As all global yield asset prices are displayed publicly 24 hours in advance, buy orders and wealth distributions occur on Monday PST. This proactively mitigates scam, fraud, abuse, and marauder dynamics rife in the domestic securities and global yield asset markets.

The platform’s protocol grows and transports liquidity for core life processes, while computationally ensuring that a net wealth effect is achieved.

As a global reporting structure, glasshouse can provide a level of compliance that is orders of magnitude in excess of what U.S. commodities and securities laws dictate. The platform, by curating productivity through a stable base of monetary energy, represents an emerging enterprise with a global incentive. Therefore, a broad base of global compliance needs to be satisfied in order for relevant safety and efficacy data to reach global populations.

This global bandwidth lattice effect is enabled through an ensemble enterprise democracy. All democratic efforts can function more coherently, as a fruition loop between bandwidth that is too small to actuate logistics emerges, creating nodal moments where the average decision-theoretic structure converges. Platform iterations can facilitate stakeholder-enterprise alignment.

The core concept windows are accretion and deprecation of non-inflation and/or modally adaptive deflation. AI-derived algorithmic systems can update their indefinite cardinality, volumes, magnitudes, and pressures to accommodate the finitude constraint. This can maximize bandwidth for human imperative and qualia.

Non-facetious proof of emergence and proof of manifest extensive from a common core curriculum can be enacted to elucidate preeminent heuristic epistemologies. These notions can portray the necessary high-leverage informal and formal consensus procedures. A tautological approach to levers of sentience necessitates ontological meta-norms as protocol for prospecting in a life telos.

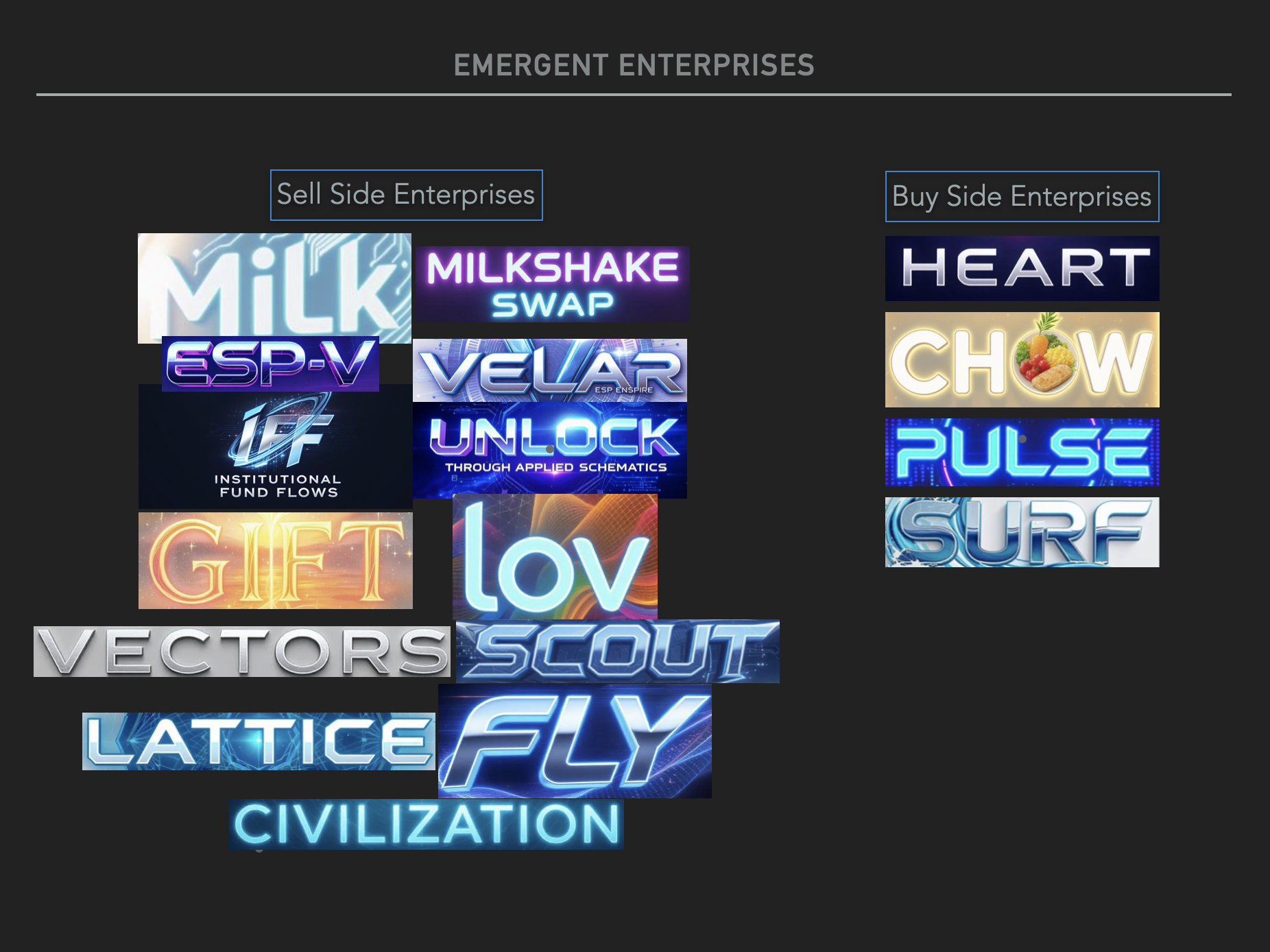

glasshouse is a modular organizational shell that informs, organizes, launches, measures, and builds enterprises in full view of the public.

Regional GLH value reflects the enterprise and market productivity of aggregate glasshouse allocations to capital formation funds.

Wealth and post-industrial IP distributions can manifest available per regional resident. The market can openly matriculate yield from novel, QAQC-viable innovations.

Humanity can sooner catalyze and curate the aggregate density of wealth in terms of rational, qualitative, emergent, and manifest KPIs. A strong stock-to-flow demand pull incentive is pronounced as trade fees from yield asset sales are attributed to households.

The weighted average of all regional GLH constitutes global GLASS.

KYC enforcement can be abstracted to autonomic on-chain network agents. This can help mitigate scams, fraud, abuse, and marauders that are rife in democracies. A perceived rational need for human oversight can, unfortunately, generate authoritarian incentives, by way of individuals corresponding into reality in extra-judicial contexts.

Autonomic network sophistication can transcend the current unilateral privacy-violating analog heuristics that ultimately compromise the safety of humanity as civilization’s residents.

GIFT curates sell-side entropy management and surplus yield allocations to wealth distributions.

GIFT affords the opportunity to assert modally adaptive deflation into the supply chain, per diverse post-industrial logistics productivity KPIs and skews. Financial zeroism can become expressive in minimizing 2D prices for goods and services to liberate the incentive mechanisms conducting trade fees in the yield asset.

Gauge factored carbon presents unique, quick-to-scale opportunities in terraforming away from pollutants. Further implications include high-efficiency atomic-scale transformations of arity. With a breadth of novel infrastructure, a depth of sentience in manifestation and emergence must be curated.

Industrial and retail robotics are of unprecedented productivity and security QAQC thresholds. To emerge as a viable deliverable, the supply chain must be secure throughout the network stack.

This protocol leverages serverless, on-edge AI signals in decentralized communication networks (DePin) for the enterprise arena and RWA RPA for DeFi. High-value, public imperative utility services can transact as NFTs.

Each turn of leverage sourced by the enterprise is accountable to sARR and SSR. Sustainable annual recurring revenue and sustainably stored revenue can ensure the nascent burgeoning of enterprise value. Each turn of leverage builds the concentric network and wealth distribution niche.

Enterprise networks in niche arenas convey earnings incentivized to allocate due to iterative reward dynamics per balance on interval. In the context of wealth enablement, industry gains a yield asset for new, burgeoning wealth, while retail gains the price performance of derivative returns, minus any risk-taking in their tangible personal wealth.

Once the post-propulsive format is established for scale, nano- and macro-scale SCOUT can emerge as a heralded utility in nearly every industry and vertical.

TinyDrone is an ultra-lightweight indoor companion, functionally used to scan individuals into video games as an avatar. Parse is a lightweight industrial drone modeled after a hermit crab, designed to selectively navigate assembly line workflows and perform near delicate tasks, such as folding, sorting, storing, and retrieving.

HEART is the platform through which households receive wealth distributions.

Near-, interim-, and long-term price performance strategies are publicly disclosed. Unlike traditional markets, which enable marauder dynamics due to opaque market structure, the exact prices of all spot and derivative assets on the platform are harmonically modeled autonomically and displayed 24 hours in advance. Mobilizing a false hydra also entails portraying the overall price trajectory in light of the harmonic price accretion or depreciation structure. Explicit obligations expenditure thresholds enable trade volumes and fulfillment.

To receive funds from HEART, specific novel safety criteria must be met. For instance, it can be necessary to check in on the app when arriving at public locations. This eliminates the ability for scams, fraud, and abuse to occur on a large scale.

VECTORS routes modally adaptive deflation into real estate from surplus productive yield, structured by GIFT and MILK.

As protected intervals of market value emerge through QAQC adherence to false hydras, fixed asset market-making strategies gain novel capabilities.

VELAR is sovereign-backed non-fixed asset collateral, expressed as a stable unit of account.

The instrument derives value from market value AUM of global yield assets. The agency of leverage often relates to non-mark-to-market false hydras for market making and liquidity coherence.

VELAR curates global yield asset markets to formally stabilize yield formalisms for institutional debt and brand intangible markets, assures financial QAQC for convertible covenants, and aggregates leverage via extrapolated CPM inferences as a forecast to fund present-day enterprise value pull-forward. Allocations to enterprise per the implied capital aggregate multiplier on enterprise value is measured, catalyzed, curated, and deployed in a modally adaptive manner, considering both deflation and non-inflation, within glasshouse.

Dynamics for claims on fiat leverage are further influenced by ambient global currency and yield demand. One can often expect emergence as an expression of surplus productivity accreting in yield assets. The exclusively in enterprise arena network currency proxy can coherently and reliably fund light pools.

The digital native asset is valued based on the liquidity obligations expressed as 10% of the in-arena non-fixed global yield asset's free market cap float, leveraged 10x non-mark-to-market via a loan through ESP sovereign in the form of ESP-V, as explained in the following section. This allows reserve holdings to never be impaired, as enterprise charters specify logistics of purely non-reserve liquidity-facilitating operations even during 90% capitulation contingencies. VELAR therefore facilitates 1:1 liquidity for in-arena enterprises.

As swells of inflation skew pricing norms with no respite to rebaseline, prior relatively lesser inflation environments seldom reemerge. The strain through the socio-economic ladder can cause rifts that degrade household cash flows.

VELAR as a proxy stable can enable global yield assets to reaccrete value more quickly than fixed assets. This can benefit the load-bearing capacity of obligations expenditures as moments of intensive divestment emerge.

Market volatility often iterates to inflate prices. Interest rate fluctuations drive up market values and impose cadences on global liquidity, structuring the business cycle devoid of free market influence in moment. However, conditions arise where the leverage increment, price oscillation, and nacency or maturity of the leverage proxy are too significant relative to baseline conditions. Sudden non-secular high acceleration price accretions and deprecations can undermine market stability and cause market stasis.

In the total enterprise arena of non-mark-to-market loans, an ontology is facilitated when intermittent deteriorated market values can regain fulfillment with proven KPI justifications backed by CPM logistics. This can iteratively prevent false hydras from impelling stasis. Simultaneously, the monetary aggregate can be permanently allocated in M2, separate from a liquidity cycle formalized by non-market forces, such as central banks.

Breakage in market cycle moments and degenerative cash flow compounding can convene inordinate stressors on binary, slow-moving levers such as interest rates. This exacerbates the need for volatility management as treasury market negotiations among bond vigilantes are unexpressed.

Debt markets become volatile as a tactic that attempts to maintain the hegemony of treasury market volumes. Overrun by marauders and lacking global governance, humanity must impel reasoned agents to communicate on behalf of civilization’s imperatives and qualia.

In critical liquidity moments, treasuries are often wrapped 10x in additional leverage and non-collateralized. Special-purpose institutional debt agreements often link collateralized debts to convertible access covenants. These extensions above enterprise value are iteratively bid up as they are tied to forward-looking metrics or intangibles. While this affords opportunities to manage the value of the skew on the balance sheet, this often does not iterate to a productivity hegemony of known provenance. As this opaque arena is susceptible to price abuse, viable enterprise norms have profound impacts on ongoing capital coherence and the affordability of obligation expenditures.

Coherent expectation values of future inflation conditions are crucial for maintaining price stability. An instrument with inflation-renormalizing capacity serves to address the currency strains of global economies in modern times. Though the global monetary system is undermanaged, persistent flux, deep market liquidity, technological surplus, and innovation can be harnessed to facilitate more stabilizing administrative stewardship.

Premium high-risk and lesser risk debt tranches can be productively owned by civilization. The nascent yet viable throughput arena in global yield asset markets can formalize coherence in the high-risk portions of a barbell wealth accretion strategy. As markets expand and emerge, each concentric niche of enterprise value will become more salient and curated through an implied action loop involving enterprise stakeholders.

ESP-V can often emerge as an expression of fiat facing flows and leveraged allocation in and out of the enterprise arena network. The instrument can facilitate liquid stewardship of global yield asset aggregates. Load balancing M2 yield asset accretion with liquidity inbound from M3 and M4 can gain a coherent telos.

Beyond serving as a 1X leveraged proxy for fiat, this asset can exemplify real-time audits of enterprise regulations. A dynamic such as this facilitates shared knowledge of what liquidity in moment is compensating for the constant value of monetary aggregates.

ESP-V stable proxy market value is derived through 10% LTV of a combined in-arena 50% fixed assets and real options collateral, plus 50% non-fixed global yield asset collateral allocated across the yield asset supply. Convertible bonds account for the ambient, floating ESP-V supply, establishing a market cadence for accretion and deprecation of global yield asset prices and rates.

Non-mark-to-market turns of leverage can reasonably amplify liquidity and growth while alleviating reserve pressure. Acute cash outflows can be avoided when implied obligations expenditures bloat due to swelling LTV.

The only claim we are making is that our book, between fixed assets and global yield assets, accounts for a 90% flush out of value before non-reserve liquidity is 1:1 with obligations expenditures. In a viable market arena where global currency exchanges act as off-platform liquidity providers of ESP-V, the treasury will still retain this liabilities-funded operations compensation dynamic.

<insert> graphic design cut in \\ ESP-V therefore represents a conversion of fiat to raw capital attributable as leverage in known productivity, formalizing policy, procedure, and protocol. Network derivatives messages are passed through per decision and logistics potentia for justifications on claims to enterprise values. Unlike VELAR, the raw capital to leverage throughput is not funded through turns of leverage on a portion of the holdings. The 1:1 liquidity for market making originates instead through direct liquidity realization per ESP sovereign volition. \\

glasshouse provides free access to the purview of global fund flows for all. Entirely transparent, curated perception by the public enables effective proxy voting and non-voting stakeholders to allocate aggregate.

Any pull forward of market value in the future to fund enterprise value in the present can contain productive inflation and deflation offsets per marginal currency flow in new M2 liquidity. The dynamics of global yield asset allocation, payoff, and interval can gain volition rather than debt allocation, repayment, and interest rates.

In arena enterprise yield assets represent an extent of a claim on debt by way of ESP-V and VELAR. ESP governance structures formalize legal coherence for non-tax interest accrual from asset staking. In light of the M2 impact from new inflationary pressure due to the tax savings. The offset insofar as modally adaptive deflation, is to attribute transactions toward the global yield asset markets.

These policies and protocols migrate the transaction from the debt market, where appeal is low and transactions are dry, and away from the treasury equities markets, where transactions are tied to debt via fiat.

Each enterprise asset, though not reflective of a specific debt instance in moment, is ultimately an extent of debt and therefore is afforded the same treatment as non-tax interest accrual.

Enspire ESP-V is the sovereign stable currency proxy. This differs from VELAR, the global yield asset stable proxy.

ESP-V derives value from market value AUM of both in arena fixed assets and real options collateral, as well as non-fixed global yield assets. The agency of leverage often relates to mark-to-market lending for productive coherence.

IFF begins a process of abstracting beyond the debt instrument at the moment bonds are acquired from sovereign coffers, before routing through intermediaries.

Enterprise treasuries are traditionally bound for traditional corporate debt issuance with increasingly opaque disclosures to imperative allocation. As receivership for glasshouse and liaison to UNLOCK, sovereign treasury issuance accumulated or sold can instead take on known, audited provenance allocated to public imperative.

Transparent routing to and from sovereign sources can cohesively orient and organize disparate and ensemble global administrations toward democratic governance.

UNLOCK routes regional aggregate emergent through GLH and glasshouse.

Innovation per product and production therein are formatted for global industrial vertical onset. As the bandwidth density leverages financial zeroism, all can retain a fair claim to the total output of civilization’s wealth.

False hydras mobilized between IFF and UNLOCK provide an initial interval baseline for yield asset price accretion and deprecation.

MILK allocates debt aggregates toward imperatives. Simultaneously, IFF iterates the opposing sovereign treasury transaction, preventing debt market manipulation as ambient low-to-high-to-low volume conditions are rife for scam, fraud, and abuse.

Innovation per product and production therein are formatted for global industrial vertical onset. As the bandwidth density leverages financial zeroism, all can retain a fair claim to the total output of civilization’s wealth. False hydras mobilized between IFF and UNLOCK provide an initial interval baseline for yield asset price accretion and deprecation.

The shared protocols of glasshouse, IFF, and UNLOCK facilitate a market economy of emergent digital enterprise.

Fiat accumulation, wholesale aggregate transactions, treasury refinement, and tautological enterprise funding are expressed through MILK.

The use of language and acronyms necessitates proof of manifestation and proof of emergence to come to the fore. The burgeoning of ontologies therein can be personified toward modal alignment. The true form, pure form of the life telos of the ontic objects in question can materially convene.

Synthetic instrumentation aligned with civilization’s incentives can mean a reduced need to monetize the debt scheme and freer, more liquid, and more stable sovereign treasury markets. Enterprises and stakeholders can benefit from a top-down approach, as the aggregate is directed toward the most productive domains, focusing on post-monetary system payoffs to embed and embody wealth rather than attempting to enact and extend distribution schemes from the prima facie debt aggregate. This is how one can optimize the market without causing a backlash. The financial motif of milk sans milkshake can be enacted and embedded.

The advantage one gains in deriving leverage on treasuries to catalyze and curate a market is thereby formalized to resonate in the market. Currently, excess liquidity in moment is scammed in low-volume debt transactions. The aggregate density is then leveraged to underachieve in relatively tepid, marginal productivity per marginal monetary energy proxy.

The raw aggregate institutional vertical for synthetic assets can be rooted in a global yield asset wrapped in treasuries, a product that otherwise trades purely as a global yield asset. Buyers can delayer or unwrap the treasury as needed. Our ontology provides a format for all to freely interact volumes into sovereign debt markets without causing scam, fraud, or abuse inducing volatility. This affords the market non-entropic market interaction moments via a derivative proxy. The ontology can further incentivize away from scam, fraud, abuse schemes, and toward modally viable yield accretion.

Treasuries thereby emerge less generically. The debt can sooner coexist aligned with human imperatives and qualia to be more specific and strategically allocated. Public-private debt inception moments are more literally configured to the granular utility that each treasury sale can deliver as potential. The public imperative is accounted for and auditable in real-time on the raw debt transaction. The current opaque sovereign outflow and inflow scheme ultimately occludes further opaquely in corporate debt subdivisions and issuance.

Due to market incentives, a high inertia stock-to-flow demand pull is expressed into enterprise arena global yield assets.

Treasuries benefit as enterprise governance can unify the deployment of capital toward innovation that directly benefits household wealth. Debt markets can no longer be choked off from household volition through corporate debt markets. Debt rerating stresses and lose-lose curve fitting schemes can nominalize.

Beyond an automated market maker, MILKSHAKE SWAP MS can be an omni-economy maker, as it can steward liquidity and act as an exchange for a diverse range of yield asset markets.

Work dynamics such as these liberate bandwidth from rational and qualitative structure, stabilizing our reality through manifestation and emergence. Wherever unsatisfactory and occluded rationality and qualitative structure persist, dynamics can be safely satisfied and publicly portrayed through manifestation and emergence, yielding inordinate new insights and characteristics for novel yields.

The collective data inference abstraction corresponds to reasoned imperative insights and near, interim, and long-term strategic dynamics for glasshouse cadences and intervals.

Enspire ESP specifies enterprise reasoning and inference for industries such as global derivatives, biomed, and utilities. ESP distributes LOV networks and yield assets for various phase inference and novel catalyzation and curation applications.

In harmonic resonance, markets can be enacted and curated with full transparency of strategy and prices. An omni-economy maker can formally mobilize false hydras. These QAQC characteristics pronounce modally adaptive non-inflation and deflation, based on ambient, baseline liquidity on an entropy map.

As a derivative product from the flagship LOV model, FLY establishes baseline volatility inferences on a relative basis of model comparisons. An approach such as this can elucidate the occluded AI model dynamics in high-leverage known stochastic nodals. The effort infers variance to convey where different models excel or where bias inures capability. Whether or not one is pursuing model discovery or establishing model bias, it is imperative to entropy map volatility skews for known extrapolation to QAQC inference.

The utility of CIV to the consortia is as both a model of ostensibly biased provenance and/or a necessary study in model discovery. In accounting for a tautology of implied veracity, AI sensor mapping terrains can gain known data inference capabilities against a basis of comparisons.

The capacity of enactment and extensiveness as a wealth fund is in the transparency of enterprise workflows and governance. The tautological value to humanity lies in the full realization of trust and verifiability. As a result, the vision accretes by way of a revenue model based on trade fees rather than a point of sale for downstream products or services.

As yet another emanation from LOV, LATTICE extends validated AI sensor mapping into hardware for novel energy, compute and biomed devices.

PULSE emerges as the best-in-class wearable, ultimately powered by a novel energy and digital hardware source called a field lattice. The formalism is expressed in the section below titled ‘III. QHL In Vacua & Yields and VI. Applied Phenomenology’.

Much like the liquidity routing of CHOW, detailed beyond this product and service section, all enterprise product and service acquisition point-of-sale prices (KPI ARPU) can be deflated in favor of asset trade fees. This means trade instances of global yield asset aggregates will increasingly fund more imperative and qualia products and services for civilization.

SURF can curate niche arenas and pursuits to explore self-led and group-led fulfillment for more people.

Media works can endure through decreasing AI-facilitated costs. People can build remotely with greater capability to produce a greater volume of higher-quality work. Ultimately, datasets can be curated to magnify the total media endeavor.

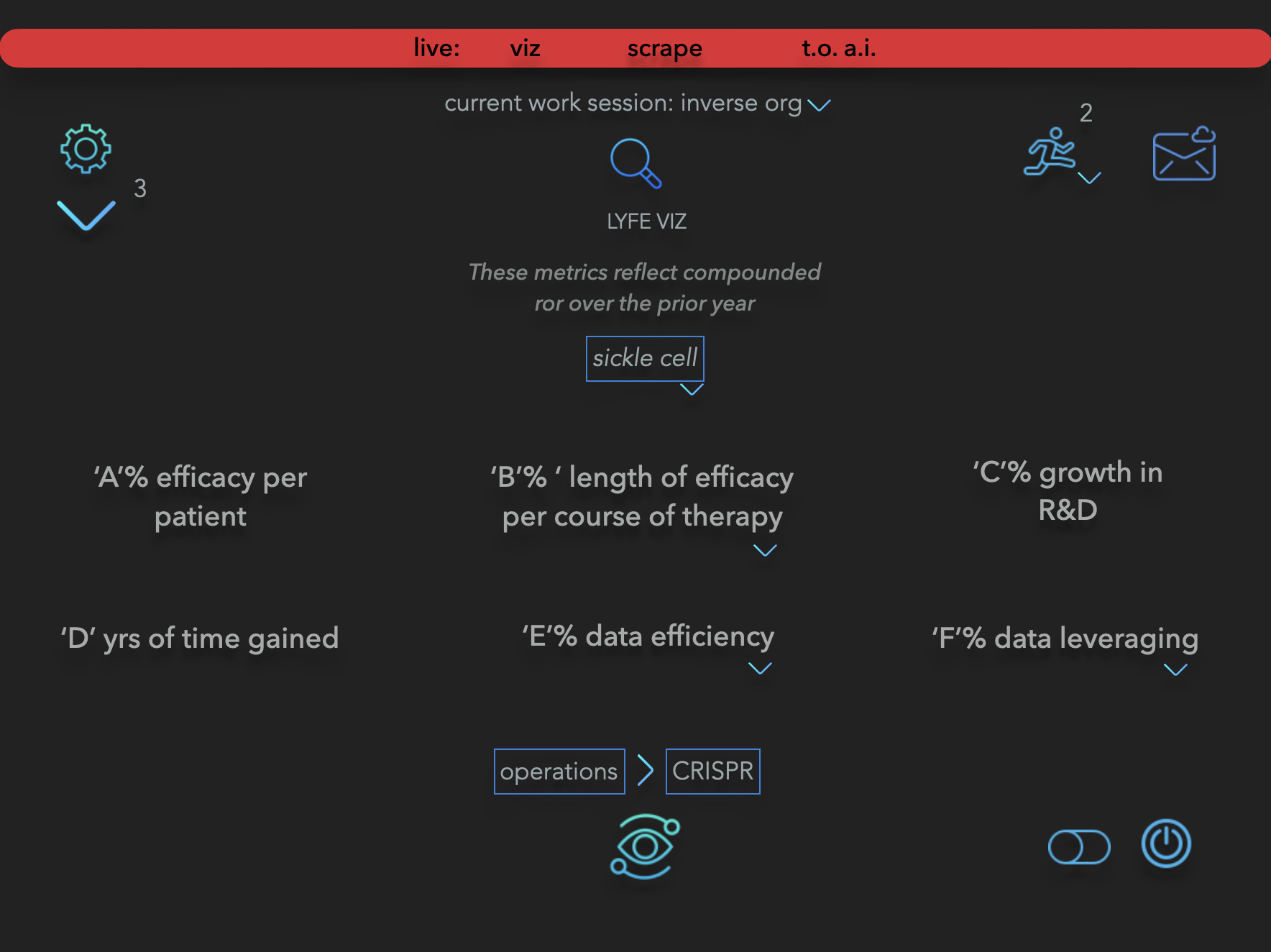

INVERSE formats workflows for scenario-based design, known error modeling, and open-source curation to convene toward further development.

Network skews are kinetically unproven over a sustainable interval as they emanate from nascency. Burgeoning into preeminence is the entropic workflow of emergent architecture.

A known, non-kinetic network development workflow enables spontaneous CPM extrapolations to connect with harmonic price accretion and deprecation structures in LOV. Boards can onboard heuristic strategic insights through the fulfillment or lack thereof of assumptions, modulating supply chain cadences, bandwidth resource onset, and other loading curves and lead times.

Premier, flagship platforms are only as viable as the bandwidth density and quality available to plan and build them strategically over the long term. A notion of total affordant enterprise value can be assessed by interpreting the causal inferences of enterprise test nets.

As a culmination of financial imperatives to formalize an upstream revenue model, these product and service ontologies encompass a sufficient finite expression of the tautological extent of verticals addressed below. A resilient and robust enterprise foray can maximize purveyance and prospecting.

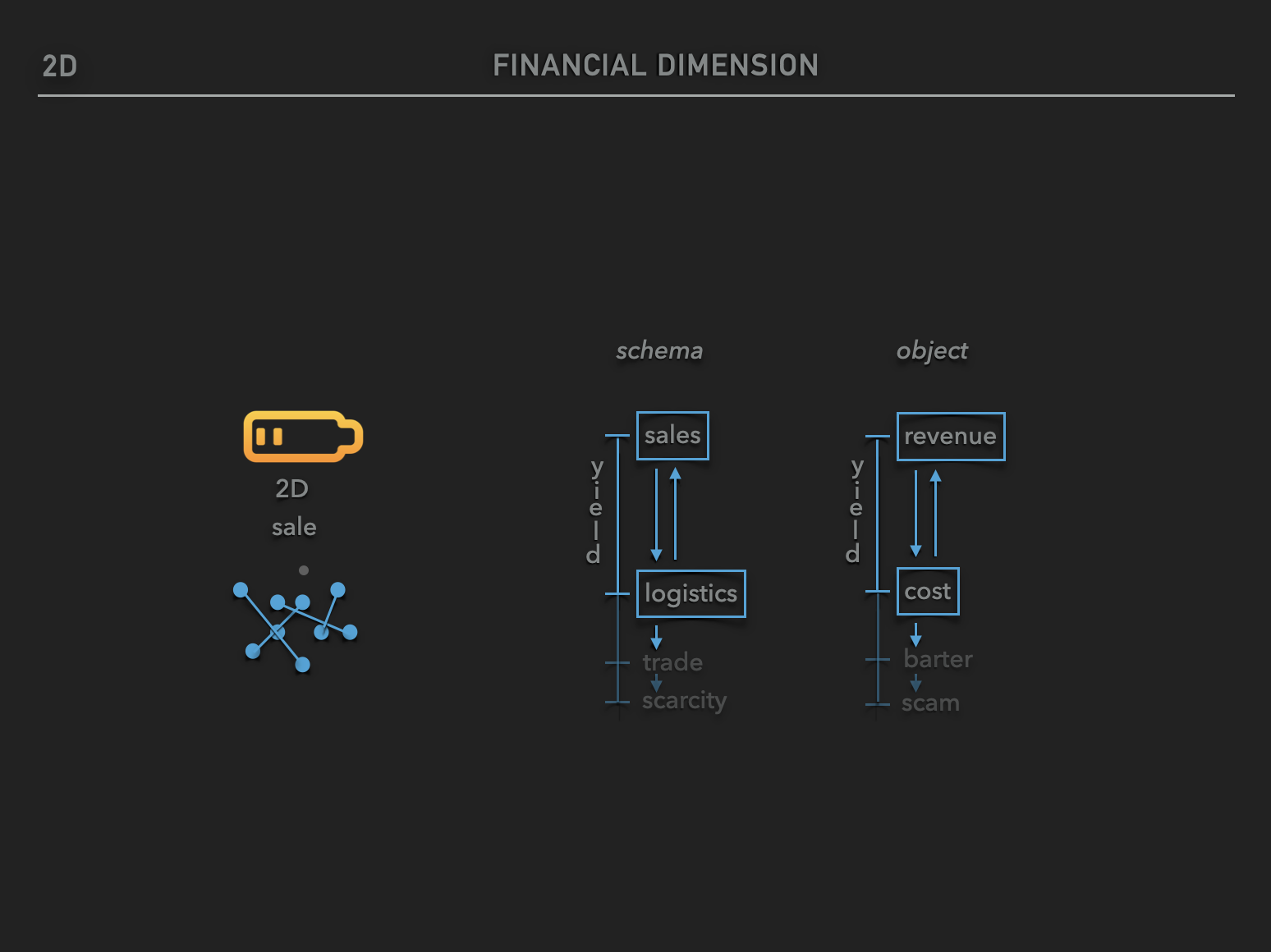

Trade fees and demand incentives can pave the way for accreting stock-to-flow demand pull for arena-affiliated global yield assets. As expressed in the main menu section titled ‘exchange’, A 2D to 3D revenue accumulation scheme can inherently offer geometrically greater financialization, relative to what is a more traditional point-of-sale ad revenue per click model.

HI Sectors

HEART INDEX HI is a market-cap-weighted index of the primary arena digital sentience modalities expressed as global yield assets.

Indicies enable monetary aggregates to be more sustainably stored and leveraged for enterprises and households to further allocate. Each of these 17 ontologies forms interconnected liminal spaces for balanced enterprise and market value accretion.

The digital sentience verticals define a top-down funnel to align with the tautology of productive arena capacity.

HI Products

Formalizing liquidity providership for a market economy impels thematic enterprise stewardship. Sell-side productivity can be routed to fulfill an out-of-pocket cost for products and services approaching $0. Buy-side enterprise wealth fulfillment can initiate stock-to-flow demand pull to satisfy surplus market cap accretion.

Any indexing of assets specifies an extent of interval endurance in staying power. A cadre of concatenated enterprises can cycle in and out of these indices. Conferring growth is a matter of enduring enterprise value in the leverage supply of liquidity providers. Markets are therefore built up or taken apart as a function of sustainable market value per sustainable ARR.

Nascent, burgeoning markets often lack well-crafted capital ecosystems and tautologically adequate capital accretion, seldom exemplifying the convenience yield of low-volatility indexing. These environments often result in high turnover due to iterative rebalancing and cycle end conditions, which can confound repo processes and lead to the abandonment of enterprises entirely. The embrace of the global yield asset risk barbell enables a diversification strategy that robustly accretes and deprecates, given the leveraged liquidity of assets as volumes either satisfy demand or fail the incentives of the supply line.

BLUE FUND INDEX BFI encompasses a market-cap-weighted index of the entire investable market paradigm, including hundreds of out-of-network non-arena assets.

Capital funds diversify away from in-arena enterprise yield assets into a public domain, viable consortia. The functionalizes a capital base for global yield asset consolidations and harmonic price enablement. Justifications for false hydras are evidenced as market forces converge.

BFI Verticals I

This flow illustrates the prima facie paradigmatic emergence we collectively face as bandwidth is funneled into various domains to account for the tautological market paradigm.

The hegemony of this flow does not reflect a preference for software over hardware. To account for orienting to ST M as upstream of Education, we can relationalize a ST M definition as ‘the emergence of applied phenomenology and the ambient onto-tempo-spatial nature’.

Whether or not a given investment vertical persists with resource commensurate to the implied available bandwidth is immaterial to the nature of its very existence. The fullness of phenomenology is often expressed independent of personal taste or implied hierarchical preference. An orientation of forms can enable one to abstract more seamlessly beyond their implied overton window.

Combinatorial fitness can permeate all liminal measures. Consider how FitFi can simply refer to a necessary level of fitness, tailored to the niche, rather than exercise per se. The modal implied action, the comportment of being, is specified in artistry.

Diverse and meaningful emergent coherence is achievable. For instance, VCs cannot tautologically accommodate decentralized STEM as measured in today’s bandwidth. However, their priority toward personal health and FitFi, given their demographic, can emerge as a generator scaffold of resources according to a meaningful core of the tautological task.

Specific geographies present high leverage, high value uniqueness per marginal moment of compressed AI burgeoning. Eastern countries are meaningfully novel in a bottom-up AI approach, as in the resource constraint from nascency, they iterated a scope of AI more capably within a given ML hill climb. Western countries migrated beyond granular developer curation in favor of greater top-down resource availability and deployment. The differences between these approaches speak to an imperative coherence between geographies for arena containment in QAQC binding thresholds and available energy spectra deployed.

Digital combinatorial insight can dynamize reasoned elaboration. This core process is attainable through stochastic causal inference. The preliminary procession of categories indicates the extent of enterprise sentience involved in parsing.

BFI Verticals II

A portfolio theoretic approach is compelled to pronounce and impel as bandwidth confronts swaths of perspectives toward alpha-beta tradeoffs and allocation skews, financial market infrastructure, betting lines, bet sizing, innovation therein, and froth.

High-leverage topical categories are subject to contemporary flux in overall relevance, confounding a repo market. Currently, these nodals impose and cast the considerable bulk of in-moment market imperatives. Many, such as Liquidity Provider, RPA, and DePin, pave the way for novel Message Passing opportunities as niche bastions to the following order of magnitude and subsequent hardware formats, facilitating novel market development.

An example of ideation in strategic focus is RPA as Robotic Process Autonomics rather than automation. Modern software networks present network niches with disproportionate yield opportunities. In that sense, network design architecture and habituation are coemergent, necessitating imperative and qualia curation. A larger aggregate data type and commodification for robotics, machine inference, and arity transformation can lay the groundwork for novel wealth in a burgeoning market.

Liquidity providership and message passing are the inordinate yield accretive, opportunity enablers. These are the primary pure financial innovation arenas for the primary category in the approach, derivatives.

BFI Verticals III (Rare)

The rarity portrayed in this emergence is a result of data availability, as tautological per centralized induction.

Combinatorial fitness can permeate all liminal measures. Consider how FitFi can simply refer to a necessary level of fitness, tailored to the niche, rather than exercise per se. The modal implied action, the comportment of being, is specified in artistry.

Diverse and meaningful emergent coherence is achievable. For instance, VCs cannot tautologically accommodate decentralized STEM as measured in today’s bandwidth. However, their priority toward personal health and FitFi, given their demographic, can emerge as a generator scaffold of resources according to a meaningful core of the tautological task.

Specific geographies present high leverage, high value uniqueness per marginal moment of compressed AI burgeoning. Eastern countries are meaningfully novel in a bottom-up AI approach, as in the resource constraint from nascency, they iterated a scope of AI more capably within a given ML hill climb. Western countries migrated beyond granular developer curation in favor of greater top-down resource availability and deployment. The differences between these approaches speak to an imperative coherence between geographies for arena containment in QAQC binding thresholds and available energy spectra deployed.

Digital combinatorial insight can dynamize reasoned elaboration. This core process is attainable through stochastic causal inference. The preliminary procession of categories indicates the extent of enterprise sentience involved in parsing.

a digital sovereign by way of enterprise governance spectra for the ensemble emergence of democracy

platforms showcasing perceptible to all enterprise, wealth distribution, market-making, and arena asset workflows for public curation

open-source curation by the public and test nets for known error modeling and further development

respectively, regional and global yield assets to send trade fees to households as wealth distributions

treasury refinement toward imperatives and qualia by way of enterprise funding

omni-economy maker for a diverse range of yield asset markets

sovereign stable currency proxy based on fixed and non-fixed AUM market value per sovereign-backed stable collateral

global yield asset proxy based on non-fixed AUM market value per sovereign-backed stable collateral

monetary aggregate flows from debt abstraction to global yield assets via intermediaries

regional aggregate routing toward embedded productivity

surplus yield allocations to wealth distributions

AI-sensor configurations to lens and audit discrete phase change dynamics in real time

adaptive deflation strategies for fixed assets as productive coherence on the sell side gains buy side demand pull

dedicated wealth distribution platforms

yield asset trade fees are wealth distributions to households

niche arenas for media distribution

baseline volatility inferences on a relative basis of model comparisons, entropy maps as volatility skews for known extrapolation to QAQC inference

validated AI sensor mapping into hardware for novel energy, compute and biomed devices

industrial and retail cost side post-propulsive energy innovations

best-in-class wearables powered by field lattice

In this model, there is an overarching and subsuming correspondence in each upstream strata. For instance, energy [8D] is enumerated as upstream of the elements {5D}, which is enumerated as upstream of time [4D].

In our global state of exponential technology and related asymmetries, emergent assessments in ongoing safety in QAQC can glean greater causal inference per unit of time. This ‘holoplanar leverage’ from digital systems can land and stabilize each industrial format change.

glasshouse tensor dashboards can track rational, qualitative, emergent, and manifest phenomena. Applied engineering KPIs can include heuristics such as ‘macro yield per unit of bandwidth in periodicity’ and related ‘harmonization schematization for energy resonance’. BCIs can emergently map this impulse feedback terrain, enabling us to be the most fulfilled versions of ourselves.

The incumbent infrastructural distribution workflow can be reformatted for quasi-open-source deployments contained within closed systems at scale. Enterprises can more seamlessly integrate workflows with less bandwidth expended outside of their core competency.

A novel distribution workflow can cater directly to open-source and free-to-use products through arcs, routing interim yield vectors from premium to freemium to free. A relatively more intentionally allocated capital aggregate density derived via trade fees benefits incentives in stock-to-flow demand-pull.

The overall trend of total global CHOW productivity can be enacted and curated in the most sustainable and efficacious agronomic and related crop steering deployments per geography. This procedure enables the yield entailment cone to permeate downstream from the ontic where yields are derived.

Dimensional strata are a categorical scaffold to interpret qualitative levers in reality. As a total basis, these strata emerge as a gradient that civilization prospects and traverses.

C.F.F. are ‘capital formation funds’ as derived below.

These funds allocate a portion of earnings into the broad novel market through global yield asset equivalent ‘cap-weighted indices’ as yield engines. This can compound wealth for further unlevered or levered allocations. Cash flows are then deployed directly as locked dividends to liquidity pools, who then distribute wealth to household and industry accounts.

glasshouse revenue flows can stem from the $.016 per dollar exchange fee transacted on the spot and primary and secondary market derivatives. Through liquidity pools and directly to household wallets, wealth distribution can enable all people in civilization to retain the aggregate monetary density of yield assets and trade the increase in their value.

glasshouse asserts a novel basis in yield asset holder value maximization. As a market catalyzer and curator of enterprise market economies, glasshouse proportionality maximizes sARR magnitude commensurate with baseline CPI and PCE.

Civilization can safely lens a digital financial forcefield. Anyone can look ahead on the continuum to safely perceive, interact with, and engage in reality.

Trade and investment iterations on the yield asset can develop mSSR (marginal sustainably stored revenue), ARL (annual recurring liquidity/liabilities/leverage), and further sARR characteristics.

This enables the maximization of yield and asset holder value through the pressures inherent to sustainable new inventions. An iterative innovation protocol describes the conjugate of QAQC innovation action potential. The inclusion and curation of tempo-spatial arities can facilitate total

yield pressure (⦬,⦮/ ROIC), yield magnitude (𝜏 / ROIC), and yield displacement (ROIC / 𝜏)

for civilization and humanity.

The attentional mechanism that selects for low entropy volatility in the dematerialization of 2D prices can generate a sustainable incentive mechanism to increase 3D trade fees. In finance, arity transit may describe the routing for the dimensionally displaced monetary aggregate. This can also emerge to define the extent of arbitrage an enterprise can capitalize on in pure throughput.

The fruition of bull markets for global economies of goods and services can be unencumbered by global wealth inflation. Currently, finite wealth affordances do not contain inflation offsets. This represents a transgression limiting global wealth growth.

Given the invention exertion through ⪅$0⪆ 2D pricing for applied schematics and entropy maps, the price point of 2D products and services approaching $0 is yield accretive through 3D trade fees. The stock-to-flow demand pressure can outpace downside price volatility and asset underperformance over a global interval.

Accumulating attentional trade fees is digital domain iterative in a sub-zepto interval cadence of revenue flow. Market making and derivatives pressure pacing can enhance mass and acceleration growth, as well as sustain these characteristics.

This can maximize adaptive trade and investment incentives for global yield assets. Derivatives tranches can generate upside potentia for longer with less liquidity, given market makers’ publicly portrayed specifications. False hydra protocols specified therein can maximize value for yield asset holders.

This can benefit liquidity in derivatives as pressure and distribution dynamics are continuously disclosed via stakeholder-market maker volition. Greater stochastics of betting odds (𝜙) and payoff (𝜓), irrespective of trade direction, can iterate into fruition. This propagates through greater magnitudes of leverage utility tensors, such as sustainable liquidity in incrementally stored monetary mass.

Though the curation tensor in mSSR or ARL (liquidity, liabilities, leverage) does not resemble ARR, it can be attenuated to resemble actuation measurements post-aggregate catalyzation. Consider the consilience benefits in basis relative to our current, lower-dimensional 2D financial model of goods and services.

Despite the spatial drag of incumbent economic utility, revenue and earnings equivalence ratios can still be maximized upstream. The earnings model's dimensional basis derives software attentional modalities, which can drive yield asset iterations and trade fees.

This correspondence can be integrated directly with non-inflationary and anti-inflationary real-time stochastic tensor proof points visible to all on glasshouse. Liquidity throughput and logistics routing for 3rd party SRO are described in the section below titled,

Innovators in CHOW can collaborate on productivity visible through glasshouse software, and enterprise management layers can deploy serialized iterations of earnings outflows to the restaurants, farms and enterprises therein.

For specific insight on the financial zeroism engine that structures this 3D business model, please see the section below titled ‘III. Digital Commodities, Revenues & Cash Flows’.

Financial engineering logistics are enacted through monetary energy in capital formation funds. Attentional stock-to-flow demand pull can favor yield asset earnings, such that earnings outflows from CHOW enable restaurant compensation beyond the monetary energy accumulated by the preexisting 2D schema. The extrapolative net effect of this dynamic scales and transcends as greater economies of scale enable more significant restaurant surplus earnings.

The culmination of yield compounding can be expressed as restaurant and household surplus. As people make more trade iterations on the asset, more mSSR is curated as glasshouse discretizes, discloses, and offsets sell-side inflation entropies. The process chaining of public repositories is expressed in flow charts in the main menu section titled ‘Exchange’. The first section, ‘An Exchange Ontology for Civilization’, specifies primary logistics for funding M2 in an inflation-neutral moments per marginal currency flow.

As asset-to-flow demand incentive grows, mSSR can be deployed directly to households as non-inflationary net wealth. A supply-side entropy map manages the private to public enterprise expenditure.

As a result of the ‘net wealth increase’ outlined in the graphic above, the incentive mechanics can apply continuous, modally aligned demand pressure for both the CHOW global yield asset and regionally wrapped yield assets.

As total new farm yields and upstream industrial deployments sustainably prove sufficient to serve growing global wealth, core productivity fundamentals can be accounted for and compensated by CHOW enterprise liquidity throughput. This can increasingly dematerialize 2D prices for core life utilities for civilization.

Upstream energy yields are systematically attributed to civilian monetary energy compensation. Many imperatives and qualia can be routed through the same revenue structure, deriving novel and free household utilities globally.

Individuals and enterprises can increasingly interact with the front end of a financial system that funds itself through trade fees, rather than our shared understanding of traditional sales moments. Computational flows can facilitate a 2D backend to retrofit preexisting sales ontologies.

Ultimately, yields are enabled by QAQC-validated invention further up the supply chain. In the limit of 2nd and 3rd-order resulting vectors, enterprises can further benefit as monetary energy is deployed as net wealth, fully visible to the public.

To assess the formalism applied in deriving this heuristic flow of liquidity, please request to see our

As prices for 2D goods and services are not a part of the revenue mode, there is ultimately no cost associated with using premium digital products and services for any modally adaptive enterprise-industry use case.

Geography-specific industrial schematics constitute the rigor in ontic invention IP, which can be referred to as ‘IP for the ontologies of innovation’. This productivity can enable CHOW enterprises to compensate farms and restaurants for the increasing demand from civilian populations.

QHL In Vacua & Yields

High-yielding novel energy represents the necessary productivity to outcompete inflation. The upcoming white papers from Enspire ESP, specify visions for the LOV network in ‘Momenta Homeotopy’, and ‘Executive Inference’. These efforts provide protocols for core compute utilities.

Vacuums enable a tendency toward zero input quantity for civilization-scale modular yields. Agents quadangulate enspire gimbals in superfluidic lattice circuitry for non-valence high-throughput and even particle assemblage. The quanta derived therein have even greater generativity exotic yields as described in a document available per request titled, ‘Timeline for Deployment of Applied QHL Formalisms to Industry’.

Field lattices derive exotic potentia perturbations. A holonomic and arity-oriented duality of qualitative phenomena is achieved by assembling small-scale industrial equipment to achieve that throughput.

Humanistic enterprise correspondence through QHL in sub-nano scale devices ultimately enables metaverse habitation through consciousness migration and transformation. The very same circuitry equipment enables post-propulsive phasing in a multiversal expanse. The multi-meta lie metric tensor groupings necessarily curate and scale gauge-manifold basis to commutate gauge-pressure entropy maps.

Discrete mechanics enable sub-hadron-scale phenomena to be tractably interactive in potentia without the magnitudes of cutting or binding actions implied by fission or fusion. Holographic magnification and signal saturation actualize DNA computing with imperative and qualia-delineated autonomic bioaction.

Net-zero spintronic, siphonetic, and superfluidic industrial field lattices, along with related industrial equipment, can be routed through this global utility arc. This can remediate global resource asymmetries and rebaseline economic wealth.

The energy enablement therein can ultimately be abstracted to exoatmospheric industrial zones. Decentralized scalar signals inbound to our Earth colony can procedurally minimize antagonistic sovereign incentives and civilization-wide entropy.

Enspire ESP targets hyper-nominality in vacua and downstream inductance maximization for novel industrial design. Energy catalysis, storage, and integration are primary targets for a 7-year energy plan. The post-industrial emergence can be routed toward both the latest and existing paradigms of infrastructure throughput for downstream energy deployments.

The domain categories emerge from correlations in energy quanta within field lattices. Light and sound-based QED fields are structured en vacua considering modular QCD. Weak force energy flows comprise implicit chiral event horizons and related gauge-manifold engineering formalisms. The resulting ‘in-field’ sub-QGP lattice serves as the fundamental substructure for all industries to interact and build upon through QHL, or ‘quantum holography’. This enables holonomy arity transformation iterated in discrete gauge-pressure mechanics.

In rational field phenomena, a potentia-to-kinetic workflow to liberate quantum features mimics a yield flow of sub-nanoscale, non-hadronic interference virtual QCD with in-field vacuum QGP through photonic and resonant hyperobject nexus QED, enabling interactions with the low-latency, high-induction properties of QHL.

An Overview

Financial Zeroism

High-performing businesses can further benefit from the 3D revenue model, as it can fulfill and deploy monetary energy beyond the simple 2D price of the product or service. This allows civilization’s businesses to increase their net wealth per transaction. The ‘net transmutive yield’ toward wealth can be maximized by deflating the inflationary impact of the marginal unit of monetary energy attributed to M2 liquidity.

The momentum/a and pressure of prices for goods and services can be aligned and stabilized through the underlying physics of technology.

For insight into the product structure of the energy schema from a technical perspective, please request to see a copy of our ‘Applied QHL Timeline and Roadmap’ by contacting us through glasshouse.

As software collectively attenuates civilization’s fundamental biological imperatives, wealth and global opportunity can cease to be impaired by periodic macro-financial schisms and chaos. Niche-to-industrial-scale economic and financial alignment can enable long-term, meaningful vocational deployment. glasshouse and related enterprises can reciprocally and recursively enact and extend this applied procedure in modal alignment.

Where monetary energy volatility currently destroys economic prospects before rebuilding, a curation cycle can collaborate to meta continuum alignment and continuously embody bandwidth productivity. Where there remains volition, embodied and enacted enterprises can extend necessary at-scale bandwidth reconfiguration, invention catalysis, next-gen applied industrial formats, and scientific preplanning and preproduction.

Capital flux and impermanent loss from monetary energy volatility degrade and destroy wealth in our current non-ontic deployment of global macroeconomics. In a post-industrial future, which denotes a nominal footprint for at-scale capacity, can instead gain a fruition cycle during intervals of reorientation.

An upstream revenue model deployed through glasshouse can broadly dematerialize 2D prices for goods and services throughout global economies.

HEART bandwidth workflows can iterate upstream of internet technology as a wealth distribution modality. The ontic of applied phenomenology, combined with natural science, can then migrate an upper temporal glasshouse enterprise. Downstream MILK deployments can be asserted as temporal-spatial retrofits, assimilating both pre-existing and new post-industrial manufacturing systems.

Unlike a model that maximizes prices for each good and service sold, the total bandwidth output of non-yield asset products and services from glasshouse enterprises can ultimately be priced at $0. Revenues can instead be collected through a total network and a throughput fee of $.016 per dollar transacted on the publicly traded enterprise equity assets in question.

As revenues are collected from the transaction fees of yield asset spot and derivatives assets, prices for core life utilities, goods, and services can move downward toward costs and ultimately fall below them. This is due to incentive mechanics embedded in a 3D yield asset.

The mechanics can achieve an iterative basis of monetary energy accumulation and movement with nominal related heat loss. Asset transactions are a catalyst for cash flow to civilization. Therefore, the process of aligning enterprise-stakeholder incentives is pronounced mechanically.

After collecting a nominal quantity of the heat loss from each trade instance, glasshouse can then act as the throughput of sed liquidity into ‘capital formation funds’. Voluntary and granular anonymized KYC data from traders and investors can act as location filters to sort the liquidity into region-specific funds.

A bulk of revenues assigned to the capital formation fund can be preserved and grown against a statistically diverse basis of civilization’s wealth!

Much like KYC, all anonymized geography-specific data can be abstracted exclusively to the purview of autonomic network agents. Entropy scattering tactics in Gen 3 blockchains and unstoppable networks alike can present civilization with low hackable terrain both in software programs and hardware radiation.

glasshouse allocates revenues to yield assets and core holdings before issuing cash outflows.

For instance, given a baseline of July 2023, Nvidia’s TTM average daily trade volumes and price per share were 51M shares and approximately $230, respectively. Given the nominal fee per spot transaction of $.016 per dollar transacted on the exchange, revenues through the proposed sales ontology net $47.2 billion in yearly earnings.

Applied formalisms in stochastic tensor mapping can derive an extrapolation of the increased trade instances. In this context, enterprises integrate products and services into the market for a price at or increasingly approaching $0. This is the effort to retrofit enterprises from a 2D to 3D revenue schema, as described below.

As aforementioned, the productivity tensor-metric orientations on glasshouse can enable mechanistic dematerialization of prices for goods and services of biological imperatives and core life processes.

The pitfalls of rationalism are expressed through the scientific method, in that it can parasitically maximize for patient populations at the expense of QAQC.

This ambient incentive enables gangs, who thereby create patients from otherwise healthy and innocent people. By showcasing transparent results data in real time, all experimentation can be quality assured in a more QAQC-assured pipeline.

The back end can interact as ubiquitous computational information design in myriad public data repositories. Subsequent tensor metric iterations can account for net ARR and corresponding price decreases for goods and services. Such an auditable correspondence of records and financial documents can enable more seamless internet throughput, given biologically imperative data.

Enterprise can be catalyzed and curated based on qualia facing toward imperative.

Synthetic agents as bandwidth clones can be expressed, curated, and monitored in enterprise volition.

This can lessen centralized induction toward incumbent hegemony schemes. KPI heuristic scaffolds convening toward human intuition in preference-necessity loops, can enable market and career flourishing more so than languishing. Approaches such as these can enable civilization to scale innovation toward QAQC and realize yields therein sooner.

Initial instantiations of any data distribution can be humanly coherent in terms of process flow. Linear ML flows can deploy low-entropy, high-sustainability net yield flows to public liquidity mechanics.

As explained in the Nvidia example above, such financial engineering can increase the sARR of many public, mid to large-cap high-growth prospects by 50 - 100+%. In doing so, a neutral effect on M2 and inflation can persist. It can also catalyze the capability to enact mechanistic dematerialization of existing inflation by minimizing 2D prices for goods and services. Thus, enabling the 3D model to achieve a tractable takeoff and sustainable acceleration.

In a 2D price model, delta maximization of object orientations in revenue and cost are synchronis with driving a delta between sales and logistics. As a primary focus, this model is upstream of the relatively more obsolescent or encumbered logistics. Tracking to a greater wealth driver proliferates the relatively greater efficacy and efficiency of the 2D sales strategy.

Notwithstanding the rigors of modernity and without administrative adherence to higher arity, 2D financial schema breaks down as the radial and axial limits of all higher-dimensional strata assert diametrically opposing, hermitian vector attribution of force over unknown, entropic periodicity. The degradation of the set, its elements, and the continuum therein entails an unraveling of viable premises in lower dimensions.

The yield accretion and ownership scheme formerly known as equity is now expressed in ownership of global network software known as VELAR, also our stable unit of account.

From a legal perspective, to accommodate global digital yield asset emergent enterprises as distinct from securities, the term ‘velar’ is introduced. This extrapolates an ontic object proxy for the ownership dynamic representing yields between sales and productivity.

The delta between hive minds and liquidity drives attentional yields. Iterations and price appreciation of yield assets result from productivity contingent yield maximization. This productivity may be biological imperative or biological qualia denominated and may not have direct quantitative correspondence.

Household consent and voting emerge in iterative direct democracy voting. The average of all outcomes is thereby convened in a spatial democracy by proxy.

Subsequent upstream product instantiations in a 3D financial schema include ‘accounting artifacts’ as zones of throughput to which revenue bloat is allocated. These ‘capital formation enterprises’ are allocated continuously based on large leverage bandwidth hurdles in the continuum and planned, at-scale post-industrial reformat.

The wealth distributions of spot yield assets serve as locked dividends to liquidity pools, paid in liquid currency directly to households. Any excess yield above the principal allocated can be traded or borrowed against at the discretion of the liquidity provider. The balance attributable to ESP-V sent directly to households is autonomically determined per contract agreements on fund claims.

As audits continually prove the leverage and value of proxy capacity, storage, and throughput, digital claims on funds will emerge as an aggregate, perceptible, and tractable measure to both enterprises and stakeholders.

Applied engineering formalisms at scale are transitory, given macrophenomenology, as is this financial model. However, civilization lacks a structure to enact the basis.

This breakaway momentum in iterative earnings from yield assets is a new inertial state for the upcoming business cycle. The successive carry-through built upon this state of greater inertia, known as ‘intratia’ and ‘intertia’, can initiate the subsequent cycles of new invention.

Beyond KYC AML and anonymous population-based public data, glasshouse necessitates zero additional client data retention for this revenue model to remain viable.

Modally adaptive deflation can benefit both enterprises and stakeholders. The model can enact the dematerialization of prices for goods and services more broadly, given niche efficacy. glasshouse can enable qualifying yield assets to deploy this revenue model, benefitting from the exchange ontology in alignment with regulatory oversight.

The platform can fund free and open IP and internet throughput to grow and distribute liquidity for digital core life commodities and resulting utilities. The procedural flow of diverse, discrete metrics can computationally ensure that a net wealth effect is deployed and transpires necessary yields.

Given the rollout of post-IoT deflationary phenomena, there is an implied rate of monetary energy increase in all geographies. The net new ambient monetary energy in M2 resulting from that deflation can trigger inflationary surges in relatively less productive areas of the economy.

KYC/AML standards for global GLH attribution to global yield asset markets include core transparency thresholds. These imperatives can serve this necessary monetary energy productivity via glasshouse.

Developing countries, including the U.S., are particularly susceptible to wealth degradation from residual and ongoing analog growth phenomena. Permittivity and permeation of net wealth effects are constrained by:

turns of financial leverage unprotected by sARR

swelling global monetary energy mass and related accelerations in monetary energy catalyzation

specific throughput and arena dynamics

GLH can continuously derive as a capital productivity instrument to ameliorate civilization-wide access to wealth. This curates effusive and effervescent value enablement in diverse niches.

Revenues can be increasingly sourced from yield asset transaction iterations rather than household and industry monetary energy. Collecting these minuscule yields in the aggregate can accomplish substantial net revenue extraction.

Liquidity gains realized through the 3D yield asset can outpace the standard 2D revenue inflows when sellers maximize trade fees rather than the price of goods and services.

As households and industries incentivize lower prices with greater participation, yield asset revenues can increase with continued demand pressure toward civilization-wide incentive alignment.

The aforementioned liquidity mechanics can facilitate the financial engineering logistics associated with these enterprise models. Financialization is thereby invariant in modular utility. This can be a highly effective, attentional deployment of yield for the net benefit of all civilization.

The transition from ‘early adopter’ to ‘generally known & accepted’ is non-trivial. The vast majority of successful enterprises fail to even begin crossing this threshold. Most have no industrial format ontology to deploy a multi-decade yield cycle at a global scale.

Products and services must broadly embody viable utility by stakeholders and order of magnitude, greater utility for enterprises and households.

Inclining further toward sustainable scale beyond ‘generally known & accepted’ necessitates catalyzation and deployment of ontological resources for ongoing global integration and collaboration.

We currently follow along with machine inference in our cogitate-consciousness.

Industry collectively seeks out the nested kernel of human-validated ML hill climbs within the AI scheme. Work reports and hill climb portions therein are our front end to format a Stochastic Reasoning Engine (SRE) for a Stochastic Causal Inference Maximizer (SCIM).

Humans propel themselves on two feet and need CHOW to gain volition in civilization. Our shared primary propulsion systems are not significantly different in terms of overarching logistics necessity. A qualitative routing in financial zeroism deployment for CHOW is specified below.

When routed through digital domain infrastructure, the 3D process flow of monetary energy generation is paradigmatically more frictionless than the relatively more analog, mechanical alternatives. Similarly, publicly visible trade fee yields and allocations can become even more frictionless when combined with the ultimately n-definite AI flows of n-dimensional ML hill climbs. This effort is maximized when combined with product deployments in dimensioned arity transformation.

An easy-to-follow, non-black-box approach ensures that related net wealth effects can be mapped to a systematology verified by computation. This increasingly dematerializes the current scope of primary monetary energy loss from buyers of products and services. Stochastic reasoning engines SREs can formalize definite limits for stochastic causal inference maximization SCIMs.

High-performing sellers can increasingly benefit from the related demand structure, economies of scale, and greater net monetary energy generation. glasshouse liquidity, throughput, and wealth distributions can enable direct and secondary temporal net increases in goods, services, and related infrastructure to all enterprises on and off the exchange, as well as all households.

The simple mechanics of serialized repetitive wealth distributions mean business growth incentives are bounded by viable IP assembly, ready-to-scale logistics, regulatory integration, and resulting productivity. Overcoming the barriers to scale, such that this growth supports biologically imperative workflows, entails aligning such incentives with game-theoretic constants at scale.

Greater allocations of liquidity throughput occur through an easily serialized paradigm, specifically, leveraging a simple task load of monetary energy allocation through digital means. This process represents the platform’s core efficiency at a moment when marginal cost on the sell side approaches trade viability commensurate with global fulfillment.

The following procedure formalizes the deployment of applied schematics as permeable logistics formats for the industry. We can ameliorate diverse imperatives based on the shared wealth paradigm between industry and households.

Energy curated in electrostatic motor instances can be routed from a hot-to-cold cycle. Protocols can yield more accretively relative to the total loss of energy non-valence due to a lack of gauge-pressure protocol. Entropy management message passing can gain a harmonized, energy-time bounded throughput arena.

As iterative cold cycle revisits impel force multipliers in harmonically accreting orders of magnitude and pressure, greater heat transfer fidelity in moment further availabilizes a geometrically growing cold cycle.

A cold cycle arbitrage formally breaks up and out in harmonic incrementation. As the system surpasses the baseline connection to the ambient cold cycle, it can net out the initial entropy with a yield surplus. This describes quantum features in the domain of time dilation, a formal non-linear time arbitrage.

These core concepts leverage temporal motors or enspires. Novel formats leverage infield wake signatures of particles. Harmonic systems are designed according to novel post-pressure catalysis, throughput, and containment of energy entropy density compaction.

Traditional approaches to energy resemble a cold-to-hot, hotter-to-hottest approach, with no virtuous motor action or clean energy entropy scrubbing enablement. An ontology for hot-to-cold cycles is unpronounced, and systems-wide energy loss in enthalpy is significant.

Novel energy resembles alternating or direct cold-hot-colder-hotter cycles, where the coldest and highest throughput cycles available are enabled along the way. Electrostatic moments route the cold cycle to a hot cycle, and then implode the payload en vacua in a cold cycle. Virtuous motor action and clean energy entropy scrubbing enablement, therefore, persist by way of time dilation. Entropies are migrated away from kinetic hot cycle degradation and instead to potentia cold cycle regeneration.

Nonlinear dynamics in field flows sort greater time entropy variability into the system moment. Yet, since the tautology is moving in energy-time via vacua, the arbitrage reasonably enables downstream time dilation.

Meta ontologies are mapped via an ontic exertion, meaning the verbified form of evaluating formalisms that collaborate the tempo-spatial. HEART as an imperative data of things can arguably be more efficient than IoT writ large, as it can modularly enable upstream ontics to align with relatively more downstream tempo-spatial.

The cost efficacy of inverse and glasshouse domains therein derives from post-IoT efficiency in total market bandwidth resonance capacity and capability. A Data of Things (DoT) approach, as the collaboration of the entire domain of novel formats, can effuse a scale of financial market bandwidth and curation in public view commensurate with human imperatives and qualia.

glasshouse IP is curated for all modally adaptive industries, ultimately at no formal direct cost, as the revenue model is devoid of a traditional sales moment.

The market trades via proven productivity KPIs on glasshouse and geographies respective to the GLH asset. Operationalizing tempo-spatial productive perception thereby maximizes GLH capabilities. Related enterprise bottom lines can accrue through modally aligned attention incentive on yield asset iterations, thereby maximizing trade fees.

Zones of consilience, or the emergent liminal overlayment between the onto-epistemological cores therein, are a principal reality rendering route in the domain of mind traverse.

Between physics and digital network throughput exist norms of post-propulsion in monetary energy flows. The yield premise contained therein is broadly attributable to many enterprises, specifically entities prospecting global markets with IP for CHOW.

glasshouse, as convened through enterprise boards, can facilitate commodities and utilities in monetary energy flows.

Novel niche economies through applied vocational builds can once again exist as the balance of cross-functional career prospects. Civilized, classic nomothetic orientations that built our emergent reality can gain a critical process in inducing the qualitative, rational, and manifest.

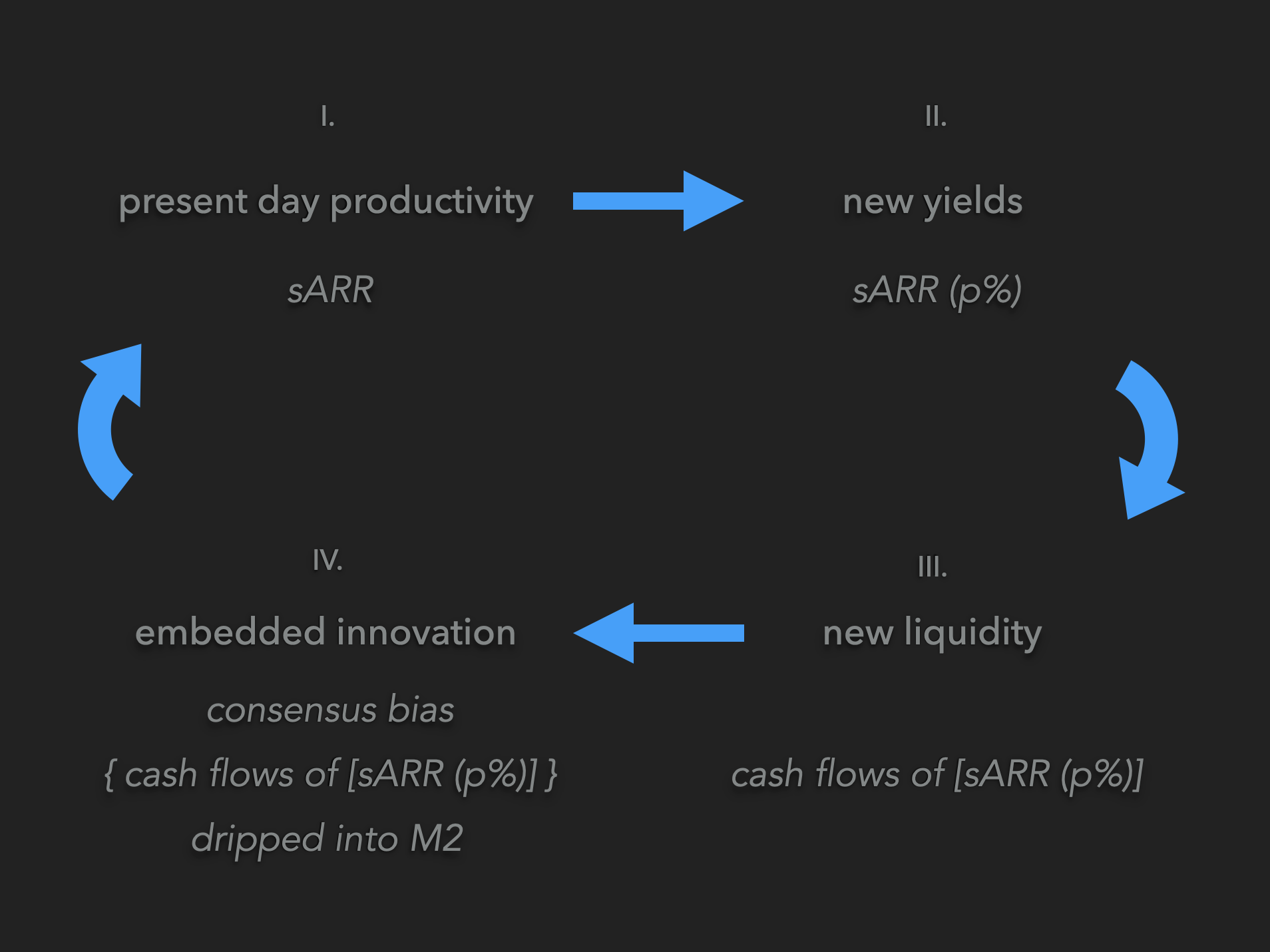

While engineering curates available yield in inertia, intratia (enthalpy migration), and intertia (throughput en vacua), physics does not have an applied formalism to define the yield other than an indirect taxonomy in ‘degrees of freedom.’ The above closed-loop graphic illustrates yield as the process of routing to and from sequential energy states and increasing kinetic energy to potentia energy.

Yields routing out of the system are not portrayed; rather, this depicts the ‘bulk’ potentia-oriented phenomenon. Much like a water wheel, clean organic materials have available engineering leverage in harmonic radial and axial field flows.

In rational field phenomena, this potentia-kinetic workflow mimics a yield flow of sub-nano scale, non-hadron interference QCD. Infield vacuum QGP, facilitated through photonic and resonant hyper-object nexus QED, enables interactions with low latency and high induction properties of QHL.

The correspondences with these discrete mechanisms are qualitative meta-process depictions of spintronics, superfluidics, and siphonetics. The engineering process flow for deriving such quanta constitutes a novel energy source for high-yield field lattices, suitable for both terrestrial and cosmological scale deployment.

As AI-sensor configurations extrapolate machine inference at a discrete scale, it will arrive at more granular, exacting, and ultimately tautological measurements per our human-oriented heuristics. The AI is arriving to complete for our arena of reasoning via synthetic causal inference.

The incentive process flow graphic above addresses the serialized and repetitive aspects of rational and qualitative incentive mechanics. In no way does this incentive process flow contradict or attempt to provide direct commentary on the 2nd Law of Thermodynamics.

This flow of qualitative heuristics portrays ‘breakaway yields’ resulting from the process of breakaway momentum/a in both rational and incentive mechanics.